To get all the important details you need on CAN YOU GET STUDENT LOANS WITHOUT FAFSA?, fafsa student loans, STUDENT LOAN FAFSA TAKEAWAY and lots more All you have to do is to please keep on reading this post from college learners. Always ensure you come back for all the latest information that you need with zero stress.

Get more information regarding Can I Get Student Loans Without FAFSA, can you get a federal student loan without fafsa, can you get student loans without financial aid & can you apply for student loans without fafsa.

Can You Get Student Loans Without Financial Aid

Is it possible to get student loans without a FAFSA?

The short answer is “yes.” But it’s not as simple as you might think. You need to be aware of the requirements and restrictions that go along with this option, including:

-You’ll have to be enrolled in school at least half time, so you’ll need to take at least 6 credit hours per semester or 12 credit hours per year.

-Your school needs to be accredited. This means that they’re recognized by an accrediting agency recognized by the United States Department of Education (USDE). If your school isn’t accredited, they won’t be able to certify your eligibility for federal student aid programs like Stafford loans or Perkins loans—which means you can’t apply for those types of aid either!

-You will need a high school diploma or GED certificate before applying for federal student aid. This means that if you’re currently still in high school, you won’t be able to apply until after graduation or when you’ve received your GED certificate from your state education department—whichever comes first.

Can You Get Student Loans Without FAFSA?

Let’s face it, the FAFSA is time consuming and can be overwhelming. So, it’s quite tempting to skip filling out the federal government’s financial aid application if possible. While you can get student loans without filling out the FAFSA, they may not be the best loans for your financial circumstances. You can obtain a private student loan without filling out the form, but if you want to get a Federal Student Loan or a Parent PLUS Loan, you must fill out the FAFSA.

When The FAFSA Is Required For Loans And Aid

When you apply to college, you can get various responses:

• Subsidized Federal Student Loans

• Unsubsidized Federal Student Loans

• Parent PLUS Loans

• College Grants and Financial Aid – Colleges require the completion of the FAFSA and/or the CSS in order to obtain grants, and financial aid monies

• College Scholarships – Some colleges require that you have a FAFSA on file in order to receive merit funds awarded from a schoolhttps://www.youtube.com/embed/wrLiyBti8QI?feature=oembed

When A FAFSA Is Not Required

There are plenty of private student loan servicers that provide student or parent loans that do not require completion of the FAFSA, such as Sallie Mae. However, they will require credit checks and loan approval, and for students, they will probably also require an adult consigner. Parents can also take out home equity loans to cover college costs – another option for obtaining funds without completing the FAFSA.

Student Loan FAFSA Takeaway

You can get student loans without completing the FAFSA, but those types of loans are through private vendors. All Federal Student Loans and Parent PLUS Loans require submission of the FAFSA – in addition to being offered grants or other forms of financial aid, such as work-study. There are also some colleges that require you to have a FAFSA on file if you have been awarded merit funds (Based on your credentials).

Looking for help with the college search and application process?

Looking for help with the college search and application process? We help students and families through the entire college planning journey – from search, applications and essays to interview prep, financial aid consultation and final school selection.

Contact us at [email protected] or by phone, 845.551.6946. We work with students in person, through Zoom, over the phone, and by email.

fAFSA student loans

The FAFSA is not a loan. It is an application form. However, you can use the FAFSA to apply for financial aid and federal student loans.

The FAFSA, or Free Application for Federal Student Aid, is used to apply for several types of financial aid, including grants, student employment and federal student loans.

Grants are a form of gift aid, which does not need to be repaid.

The FAFSA is what determines whether or not you can participate in work-study. The money awarded for work-study needs to be earned by working a part-time job, and does not need to be repaid. Read our Complete Guide to Work-Study.

Student loans, on the other hand, must be repaid, usually with interest.

Filing a FAFSA is a prerequisite for receiving several types of student loans, including:

- Federal Direct Stafford Loan

- Federal Direct PLUS Loan, including Parent PLUS and Grad PLUS loans

The federal government requires you to file a FAFSA before you can receive a Direct Loan to ensure that you get all of the other aid for which you are eligible.

Private student loans and private parent loans do not require the FAFSA.

FAFSA Resources

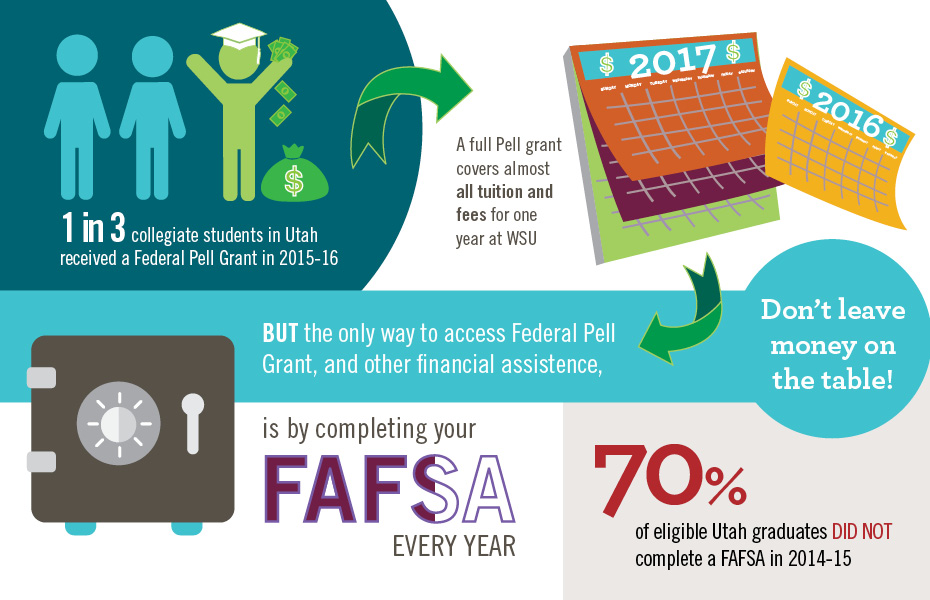

What is FAFSA and why do you need it?

The Free Application for Federal Student Aid (FAFSA) is often the main source of financial aid for GEAR UP students. The amount and type of financial aid a student receives through the FAFSA is based on how much annual income their household earned prior to applying, taking into consideration the household size and how many household members will be attending college. FAFSA money is awarded in three ways: Grants (free money), loans (borrowed money), and work-study (earned money). It is possible to be awarded all three, but we discourage accepting any loans if possible, which is discussed in more detail on our Planning for College page.

Some students might have circumstances (for example: undocumented families) that keep them from being able to complete the FAFSA application. Do not lose heart. There are still very good resources for paying for college for students in these situations. Please see our webpage about other sources of financial aid for DACA students.

DACA Students

Before You Begin the FAFSA

Before starting your FAFSA application, take a moment to review and complete the checklist below. Make sure to gather this required information. Doing so will ensure you can submit your FAFSA application without delay.

Use the FAFSA Guide Sheet to help you keep everything you will need in one place.

Yes, you can get student loans without FAFSA, but it’s not as simple as just filling out a form. The process of getting student loans without FAFSA can be tricky, and you’ll need to make sure that you’re following the right steps.

To get student loans without FAFSA, you’ll need to fill out the Free Application for Federal Student Aid (FAFSA). Then, if you qualify for financial aid, the college or university will award you aid based on your needs and how much money they have available.

If you don’t qualify for financial aid, or if your award letter isn’t enough to cover your tuition costs, then you’ll need to take out private loans. These are loans that aren’t backed by the government and require an application process similar to applying for a credit card.

private student loans

Private student loans are used to pay for college costs, but they originate with a bank, credit union or online lender rather than the federal government.

Private student loans can be a good option if:

- You have already completed the Free Application for Federal Student Aid, known as the FAFSA, to see if you’re eligible for federal grants, work-study and federal loans.

- You have already borrowed the maximum in both subsidized and unsubsidized federal student loans.

- You have good credit (a credit score of 690 or above) or a co-signer who does. Most private student loan borrowers have a co-signer.

- You borrow only what you need.

Below, you can get personalized rates and find NerdWallet’s top-ranked private student loans for students, parents, independent students, international students, part-time students and graduate school.

Best Private Student Loans

| Lender | NerdWallet rating | Min. credit score | Fixed APR | Variable APR | Learn more |

|---|---|---|---|---|---|

| Sallie Mae Private Student Loan | 4.5/5Best for Private student loan | Mid-600’s | 4.50-14.83% | 5.00-15.33% | CHECK RATEon Sallie Mae’s website |

| Ascent Credit-based Student Loan | 5.0/5Best for Private student loan + International students | Varies | 4.62-15.18% | 5.31-14.07% | CHECK RATEon Ascent’s website |

| College Ave Private Student Loan | 5.0/5Best for Private student loan + Part-time students | Mid-600s | 3.99-14.96% | 3.99-14.86% | CHECK RATEon College Ave’s website |

| Earnest Private Student Loan | 4.5/5Best for Private student loan | 650 | 4.49-13.95% | 4.49-13.25% | CHECK RATEon Earnest’s website |

| SoFi Private Student Loan | 4.5/5Best for Private student loan | Mid-600s | 4.49-14.75% | 4.62-13.82% | CHECK RATEon SoFi’s website |

| Discover Undergraduate and Graduate Student Loans | 4.0/5Best for Private student loans | Does not disclose | 5.49-15.99% | 5.87-16.72% | CHECK RATEon Discover’s website |

Ways You Can Pay for College Without the FAFSA

There are several different ways your student can tackle paying for college without the FAFSA. Think of it like this: Financial aid is like a puzzle. Colleges put different pieces of aid together to create a financial aid award.

Scholarships

Your child could see dollars in her pocket if she taps into merit-based scholarships, community scholarships, online and military scholarships. Scholarships are typically based on academic achievement, special talents and/or other characteristics. For example, your child may be an excellent oboe player and one of the colleges she’s interested in may have a music scholarship available.

Merit-Based Scholarships

Don’t assume that merit-based scholarships are just for straight-A students. They’re not.

The schools your child is looking at will be able to guide you both through the merit-based scholarships that are available. Call or email the financial aid office at each school for more information about merit-based scholarships. Merit-based scholarships can be any amount — your child may be able to receive a $35,000 scholarship (or more!) at a private college.

Community Scholarships

Encourage your child to research scholarships in your community. There are so many scholarship dollars that go unclaimed in communities nationwide — so don’t let the scholarship from the local dentist’s office pass by. Pay close attention to the scholarships’ requirements. Does your child have to write an essay? Compile a resume? Complete an interview?

Community scholarships may just come in small chunks of money — but those $1,000 scholarships can add up. Bonus tip: Look for scholarships that have a renewable component each year.

Online Scholarships

Your child can find online scholarships galore with a few simple keystrokes on Google. For example, a quick search for Kiwanis scholarships offered its scholarship opportunities page. Do thorough research with your student!

Military Scholarships

Nonprofit organizations offer scholarships to veterans, future military personnel or active-duty personnel. Your child may also be able to get a military scholarship if he or she is related to veterans or active-duty personnel.

Grants

What are grants and how are they different from scholarships? Grants are usually given out by specific formal entities such as a government department, corporation, foundation or trust.

Merit-Based Grants

Your child won’t qualify for need-based grants because you’d have to file the FAFSA in order to receive them. Merit-based grants are often offered to reward high-achieving students and can usually be used at the college of your choice. Be sure to read all the grant details to be sure. Search for them online and look for grants specifically offered in your state.

Leave a Reply