Accounting is an incredibly stable career. No matter how much technology advances, business landscapes change or economic challenges occur, accountants will always be essential to preparing, reporting and examining financial information.

With their vital role in business, it’s no wonder that accounting is also a growing career. According to labor market analytics firm EMSI, jobs for accountants and auditors are expected to grow by 8.4% between 2020 and 2030.

While jobs are readily available, entry-level salaries are modest compared to top earners in this profession. According to Glassdoor salary data, the typical salary for an entry-level accountant is $49,284. However, as you progress in the accounting field, you have the potential to earn over six figures.

How do you reach these higher pay grades? A master’s degree in accounting is one way to help fast-track your career and increase your earning potential.

Let’s look at how a master’s degree in accounting can pay off.

What Determines How Much An Accountant Will Make?

There are many factors that go into determining how much an accountant can make. The biggest influences on salary include:

- Education: The type of degree you earn, level of education (bachelor’s vs. master’s) and even university you attend will have an impact on salary expectations. In accounting, a master’s degree will not only help increase your salary, it will also qualify you to take industry examinations to earn important credentials like the CPA (Certified Public Accountant).

- Credentials: Becoming certified in your area of expertise will immediately boost your earning potential. While a CPA is the most common credential for accountants, it’s not the only option. Getting your CFA (Certified Financial Analyst), EA (Enrolled Agent), CIA (Certified Internal Auditor) or other professional certifications can help increase your salary.

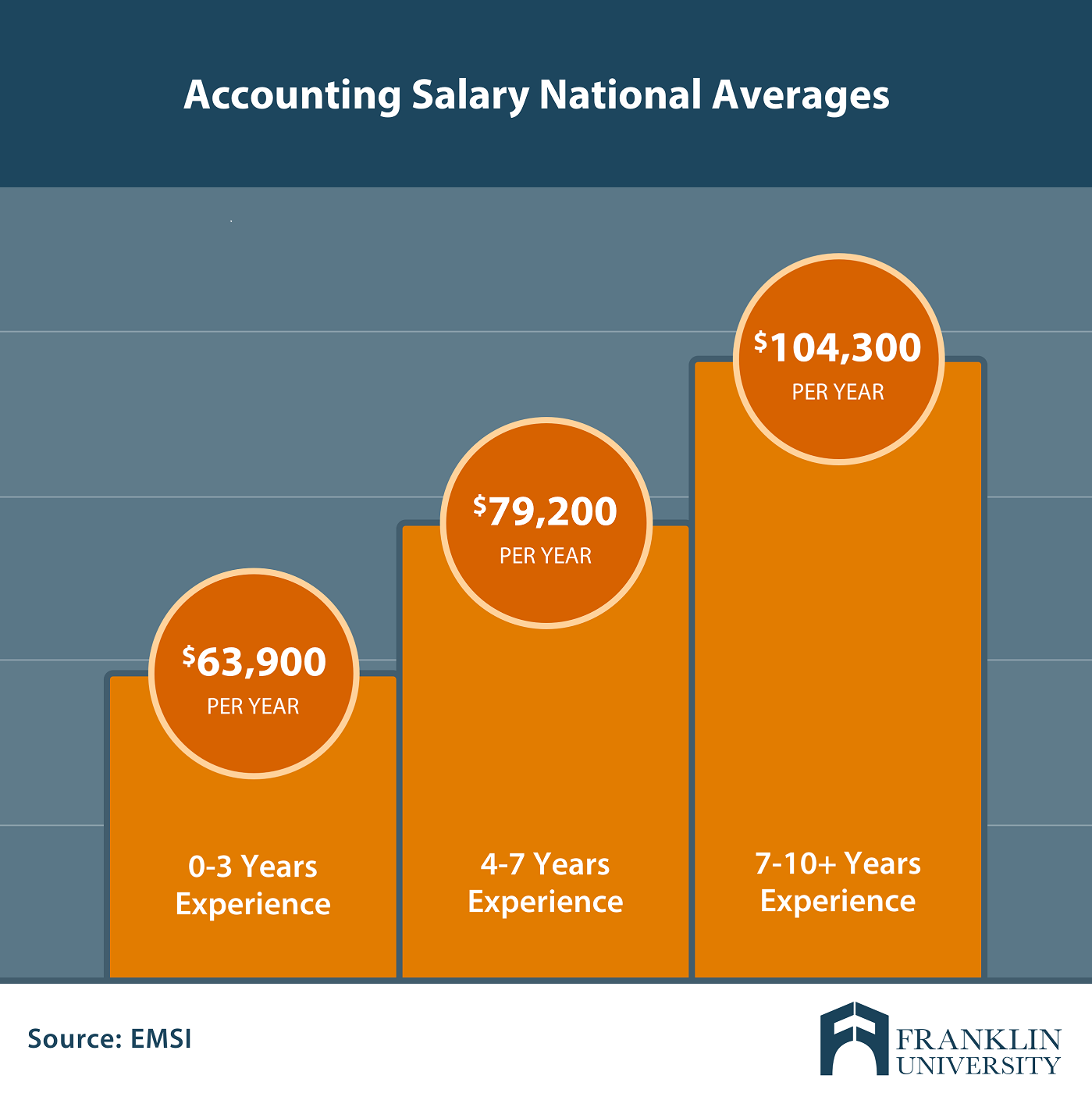

- Experience: Years of experience plays a crucial role in determining the jobs you’re qualified for and the salaries those roles command. For example, according to EMSI, over the past 5 years, jobs posted for accountants with 0-3 years of experience averaged $63.9K in salary, 4-7 years of experience averaged $79.2K in salary and 7-10+ years of experience averaged $104.3K in salary.

- Leadership Level: With increased job responsibilities comes increased salaries. As you progress into roles that involve tasks like managing others, strategic planning and budgeting, you can expect to earn more.

- Employer: The size of your company, industry you work in and how competitively they pay employees all factor into what you can expect to earn. For example, you’ll earn more working for one of the Big 4 Accounting Firms (Deloitte, PwC, Ernst & Young, and KPMG) than you would at a small nonprofit.

- Geographic Location: The cost of living in your area has a significant impact on salaries. For example, job postings for accountants with master’s degrees in California, with the second-highest cost of living in the U.S., averaged $87.3K in salary over the past five years. However, in Mississippi, where cost of living is lowest in the U.S., job postings for accountants with master’s degrees only commanded $64.9K on average.

Why is a master’s degree so important? A master’s degree in accounting will not only raise your salary prospects, it will also increase your job stability and desirability as a candidate—even during challenging economic times.

Salary Averages For Accountants & CPAs With A Master’s Degree

For many considering a master’s degree in accounting, this degree is a way to earn the required 150 semester hours needed to take the CPA exam. The average bachelor’s degree only requires 120 credit hours to graduate, resulting in a 30 hour gap. The best way to fulfill this requirement is by getting a master’s degree, which provides an additional credential that will increase your earning potential.

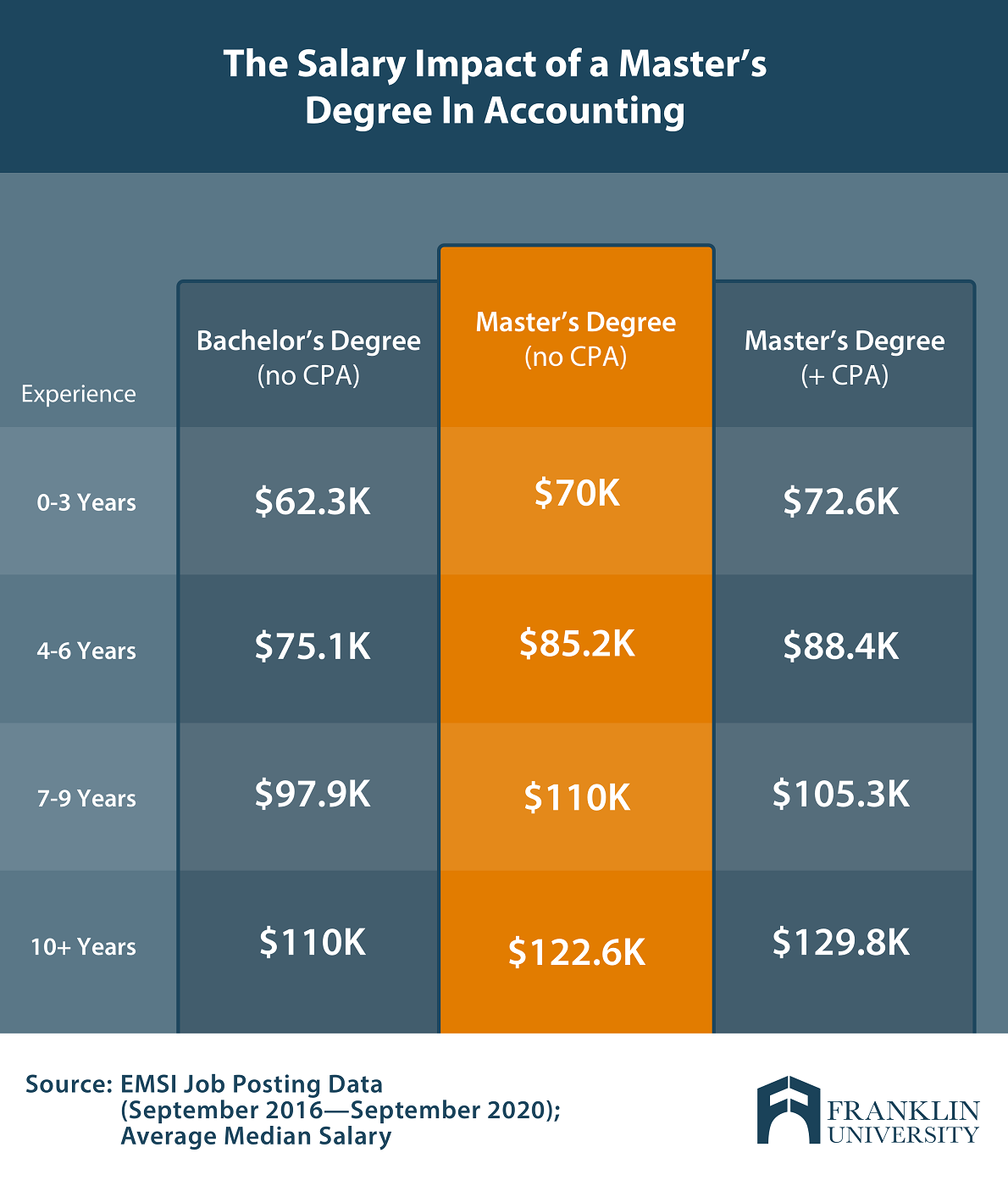

Even before you get your CPA—or if you never get a CPA—a master’s degree will boost your salary as an accountant or auditor compared to only earning a bachelor’s degree. According to EMSI, a master’s degree raises your salary expectations by 11%-14% at every stage of your career.

What matters most when choosing a master’s program? Compare features, benefits and cost to find the right school for you.

If you get your master’s degree in accounting and earn your CPA you can also expect higher than average salaries. According to EMSI, the median advertised salary for a CPA with a master’s degree is $82.8K, which is $11.3K higher than the government-recorded median salary for accountants and auditors.

This goes to show that as you earn more credentials, your salary typically goes up as well.

What is the Difference In Salary Between A Master’s Degree in Accounting and an MBA?

Some business professionals weigh the pros and cons of getting a master’s degree in accounting and earning an MBA. These options offer two very different career paths:

- A master’s degree in accounting provides deep expertise and specialization in the accounting function and is for professionals who know they want a long-term career in accounting.

- An MBA provides cross-functional skills across all business functions, which helps professionals round out their skillset to work in cross-discipline leadership positions.

In terms of salary, Payscale reports the median salary for someone in business administration at approximately $85,000, while the average salary for someone in accounting is around $67,000. The MBA vs. M.S. in Accounting starting salary is also different, with MBA starting around $85,000 and M.S. in Accounting starting around $69,000.

While MBAs seem to earn more on average, there is a wide range of salaries in either of these career fields. To truly understand earning potential, it’s easier to evaluate the salaries of individual jobs.

Top Average Accounting Salaries By Job Title

There are many different accounting career paths. If you get a master’s degree in accounting, even more doors will open to high-paying careers.

Let’s look at 5 of the popular career paths for accountants with a master’s degree, as well as the salaries they should command in 2021 (according to Robert Half, one of the largest global human resource consulting firms).

Accounting Manager

Median Salary: $95,750

Accounting manager is one of the most traditional career paths, focused on reliably tracking, monitoring and evaluating the financial status of an organization. With such a broad base of responsibilities, there is also a wide need for these professionals. EMSI reported nearly 20,000 job postings for accounting managers between September 2019 to September 2020.

Senior Tax Accountant

Median Salary: $90,500

A senior tax accountant is responsible for preparing and filing complex tax returns for companies. Responsibilities also include compiling supporting financial documents in case of inquiries from regulatory agencies and auditing work of more junior staff.

Controller

Median Salary: $121,500

Controllers are responsible for the overarching accounting operations of a company. These professionals oversee the creation of periodic financial reports, maintenance of accounting records, and a full set of controls and budgets that mitigate risk and enhance accuracy of financial results. Experienced professionals like these are in great demand, as EMSI reported over 20,000 jobs were posted for Controllers between September 2019 to September 2020.

Forensic Accountant

Median Salary: $95,500

Forensic accounting is becoming a popular specialty within the accounting world. These professionals often work in tandem with law enforcement to audit financial records and data to locate evidence of fraud and other financial crimes. While this is a niche career path with fewer job openings each year, a master’s degree in accounting is a great way to set yourself apart from other candidates.

Internal Auditor — Manager

Median Salary: $116,750

Internal Auditors are accounting professionals who guide organizations on how to practice financial accuracy, improve internal controls and adhere to regulatory statutes. These professionals are critical to reducing risk and ensuring financial compliance.

Corporate Compliance Officer

Median Salary: $106,750

A compliance officer has dual responsibilities—both internal and external. These professionals are responsible for understanding outside regulatory and legal requirements, as well as internal policies and bylaws, in order to execute financial operations that adhere to these standards. As this is a leadership position, a master’s degree in accounting can be pivotal to advancing to this level.

Find the Best Master’s Degree in Accounting For Your Goals

There are many different accounting master’s degree programs, which can make it hard to choose the right one. If you’re a working professional, you need the flexibility and support to advance your education while continuing your career.

Franklin University’s Online M.S. in Accounting Degree is designed for busy working adults who want to advance their career. Our IACBE Accredited program follows industry best-practice standards for business education. Finish your master’s degree in accounting in as few as 17 months while tailoring your curriculum to your interests.

Get more details about the Online M.S. in Accounting Degree to see how this degree can help you increase your salary expectations—now and into the future.

What are Top 10 Highest Paying Cities for Masters Accounting Jobs

We’ve identified 10 cities where the typical salary for a Masters Accounting job is above the national average. Topping the list is San Mateo, CA, with Berkeley, CA and Daly City, CA close behind in the second and third positions. Daly City, CA beats the national average by $10,724 (16.9%), and San Mateo, CA furthers that trend with another $13,630 (21.5%) above the $63,490 average.

Significantly, San Mateo, CA has a very active Masters Accounting job market as there are several companies currently hiring for this type of role.

With these 10 cities having average salaries higher than the national average, the opportunities for economic advancement by changing locations as a Masters Accounting appears to be exceedingly fruitful.

Finally, another factor to consider is the average salary for these top ten cities varies very little at 9% between San Mateo, CA and San Francisco, CA, reinforcing the limited potential for much wage advancement. The possibility of a lower cost of living may be the best factor to use when considering location and salary for a Masters Accounting role.

| City | Annual Salary | Monthly Pay | Weekly Pay | Hourly Wage |

|---|---|---|---|---|

| San Mateo, CA | $77,121 | $6,427 | $1,483 | $37.08 |

| Berkeley, CA | $74,424 | $6,202 | $1,431 | $35.78 |

| Daly City, CA | $74,215 | $6,185 | $1,427 | $35.68 |

| Richmond, CA | $72,442 | $6,037 | $1,393 | $34.83 |

| Irvine, CA | $72,002 | $6,000 | $1,385 | $34.62 |

| Odessa, TX | $70,879 | $5,907 | $1,363 | $34.08 |

| Stamford, CT | $70,540 | $5,878 | $1,357 | $33.91 |

| Orange, CA | $70,340 | $5,862 | $1,353 | $33.82 |

| Bellevue, WA | $70,340 | $5,862 | $1,353 | $33.82 |

| San Francisco, CA | $70,203 | $5,850 | $1,350 | $33.75 |

What are Top 5 Best Paying Related Masters Accounting Jobs in the U.S.

We found at least five jobs related to the Masters Accounting job category that pay more per year than a typical Masters Accounting salary. Top examples of these roles include: Vice President Accountant, VP Accountant, and VP Bachelor Business Administration.

Importantly, all of these jobs are paid between $17,210 (27.1%) and $74,107 (116.7%) more than the average Masters Accounting salary of $63,490. If you’re qualified, getting hired for one of these related Masters Accounting jobs may help you make more money than that of the average Masters Accounting position.

| Job Title | Annual Salary | Monthly Pay | Weekly Pay | Hourly Wage |

|---|---|---|---|---|

| Vice President Accountant | $137,597 | $11,466 | $2,646 | $66.15 |

| VP Accountant | $137,597 | $11,466 | $2,646 | $66.15 |

| VP Bachelor Business Administration | $100,962 | $8,414 | $1,942 | $48.54 |

| MBA Student | $80,880 | $6,740 | $1,555 | $38.88 |

| MBA Trainee | $80,700 | $6,725 | $1,552 | $38.80 |