To say the article below brings you the best information on michigan state university graduate programs & michigan state university world ranking 2021 is an understatement as it brings you much more. Read on to discover the latest.

You will also find related posts on michigan state university top ranked programs, university of michigan qs ranking & michigan state university ranking computer science on collegelearners.

About Michigan State University Top Ranked Programs

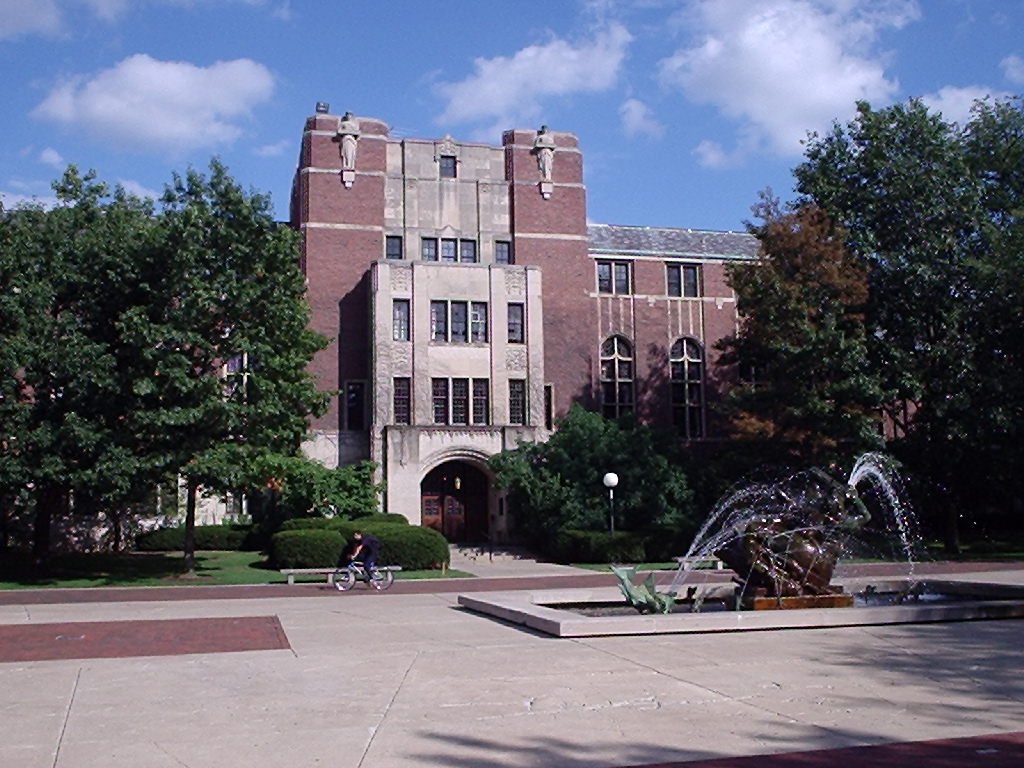

Michigan State University (MSU) was created in 1855 and was the first of America’s “land-grant” universities — institutions handed land to create an environment “where the leading object shall be, without excluding other scientific and classical studies and including military tactics, to teach such branches of learning as are related to agriculture and the mechanic arts…in order to promote the liberal and practical education of the industrial classes in the several pursuits and professions of life.”

![Michigan State University [MSU], East Lansing Courses, Fees, Ranking, & Admission Criteria](https://images.static-collegedunia.com/public/college_data/images/studyabroad/appImage/72060%20cover.jpg?tr=w-2000,c-force)

Today, MSU is one of the largest institutions in the US in terms of enrolment, with over 50,000 students, and is sprawled across a 5,200-acre campus in East Lansing. It also operates a campus in Dubai. Its alumni reach is over 540,000 strong, spread all over the world.

MSU is a multi-disciplinary research institution and this is reflected in its diverse range of accolades. Alfred D. Hershey, who took his undergraduate and doctoral degrees at MSU, won the Nobel Prize in Physiology or Medicine in 1969, while one of the world’s greatest ever basketball players Earvin “Magic” Johnson was a keen student at the university before being drafted by the NBA. MSU’s College of Communication Arts and Sciences has a particularly rich history, cultivating eight Pulitzer Prize winners. Richard Ford, another Pulitzer Prize winner for his novel Independence Day, also studied at MSU.

MSU students are dubbed ‘Spartans’ when they enter the institution and the university’s large sports programme, which has 25 varsity squads.

Michigan State University – Eli Broad College of Business

Executive MBA

United States

| OVERALL RANK | 57 | |

| PERSONAL DEVELOPMENT AND EDUCATIONAL EXPERIENCE | 56 | |

| QUALITY OF STUDENTS | 58 | |

| Pre-MBA salary of students, $ | 98,208 | 54 |

| Work experience, years | 13.0 | 52 |

| Managerial work experience, years | 5.0 | 62 |

| Rating of culture and classmates, out of five | 4.38 | 41 |

| STUDENT DIVERSITY | 56 | |

| Number of industry sectors from which students applied | 9 | 51 |

| Percentage of women students | 26.6 | 36 |

| Geographical spread of students, rating out of 100 | 15.1 | 47 |

| QUALITY OF FACULTY | 44 | |

| Rating of faculty by students, out of five | 4.50 | 32 |

| Percentage of full-time faculty with a PhD | 88 | 50 |

| Ratio of full-time EMBA faculty to EMBA students | 0.22 | 54 |

| Student rating of teaching quality, out of five | 4.51 | 40 |

| PROGRAMME QUALITY | 48 | |

| Student assessment of facilities, out of five | 4.29 | 45 |

| Student assessment of programme content and electives, out of five | 4.14 | 41 |

| Student rating of relevance, out of five | 4.46 | 35 |

| Number of compulsory overseas assignments lasting more than one week | n/a | 55 |

| Rating of the ease to which students can keep in contact with fellow students/faculty when off campus, out of five | 4.38 | 35 |

| CAREER DEVELOPMENT | 48 | |

| CAREER PROGRESSION | 24 | |

| Rating of the extent to which the programme has helped students fulfill pre-EMBA goals, out of five | 4.34 | 41 |

| Percentage of students who have been promoted or grown their own company since graduation | 79 | 11 |

| SALARY | 50 | |

| Percentage increase on pre-EMBA salary for alumni, on leaving the programme | 42.7 | 13 |

| Percentage increase on pre-EMBA salary for alumni, after one year | 28.7 | 47 |

| Percentage increase on pre-EMBA salary for alumni, after two years | 25.8 | 54 |

| Base salary of EMBA graduates, $ | 140,161 | 54 |

| NETWORKING | 50 | |

| Number of overseas MBA alumni branches | n/a | 59 |

| Student assessment of the helpfulness of EMBA alumni | 3.89 | 35 |

Set on a sprawling 5,300 acre campus in East Lansing, MI, Michigan State University is a major land-grant university. MSU offers over 160 undergraduate majors, with popular programs include business, biological sciences, communication and engineering. Undergraduates can participate in research at the prestigious Kellogg Biological Station. The vast majority of students at MSU hail from Michigan, and over 60% of graduates stay in Michigan following graduation. MSU offers a range of merit and talent scholarships, including the competitive Alumni Distinguished Scholarship, which covers the cost of attendance. MSU boasts an accomplished group of alumni, with 49 Goldwater Scholars, 20 Rhodes Scholars, 20 Marshall Scholars and 17 Truman Scholars

Absolute advantage

Adaptive expectations

Adverse selection

Advertising

Agency costs

Agricultural policy

Agriculture

Aid

Altruism

Amortisation

Animal spirits

Antitrust

Appreciation

Arbitrage

Arbitrage pricing theory

Asian crisis

Assets

Asymmetric information

Asymmetric shock

Auctions

Austrian economics

Autarky

Average

Absolute advantage

This is the simplest yardstick of economic performance. If one person, firm or country can produce more of something with the same amount of effort and resources, they have an absolute advantage over other producers. Being the best at something does not mean that doing that thing is the best way to use your scarce economic resources. The question of what to specialise in–and how to maximise the benefits from international trade–is best decided according to comparative advantage. Both absolute and comparative advantage may change significantly over time.

Adaptive expectations

A theory of how people form their views about the future that assumes they do so using past trends and the errors in their own earlier predictions. Contrast with rational expectations.

Adverse selection

When you do business with people you would be better off avoiding. This is one of two main sorts of market failure often associated with insurance. The other is moral hazard. Adverse selection can be a problem when there is asymmetric information between the seller of insurance and the buyer; in particular, insurance will often not be profitable when buyers have better information about their risk of claiming than does the seller. Ideally, insurance premiums should be set according to the risk of a randomly selected person in the insured slice of the population (55-year-old male smokers, say). In practice, this means the average risk of that group. When there is adverse selection, people who know they have a higher risk of claiming than the average of the group will buy the insurance, whereas those who have a below-average risk may decide it is too expensive to be worth buying. In this case, premiums set according to the average risk will not be sufficient to cover the claims that eventually arise, because among the people who have bought the policy more will have above-average risk than below-average risk. Putting up the premium will not solve this problem, for as the premium rises the insurance policy will become unattractive to more of the people who know they have a lower risk of claiming. One way to reduce adverse selection is to make the purchase of insurance compulsory, so that those for whom insurance priced for average risk is unattractive are not able to opt out.

Advertising

Many firms advertise their goods or services, but are they wasting economic resources? Some economists reckon that advertising merely manipulates consumer tastes and creates desires that would not otherwise exist. By increasing product differentiation and encouraging brand loyalty advertising may make consumers less price sensitive, moving the market further from perfect competition towards imperfect competition (see monopolistic competition) and increasing the ability of firms to charge more than marginal cost. Heavy spending on advertising may also create a barrier to entry, as a firm entering the market would have to spend a lot on advertising too.

However, some economists argue that advertising is economically valuable because it increases the flow of information in the economy and reduces the asymmetric information between the seller and the consumer. This intensifies competition, as consumers can be made aware quickly when there is a better deal on offer.

Agency costs

These can arise when somebody (the principal) hires somebody else (the agent) to carry out a task and the interests of the agent conflict with the interests of the principal. An example of such principal-agent problems comes from the relationship between the shareholders who own a public company and the managers who run it. The owners would like managers to run the firm in ways that maximise the value of their shares, whereas the managers’ priority may be, say, to build a business empire through rapid expansion and mergers and acquisitions, which may not increase their firm’s share price.

One way to reduce agency costs is for the principal to monitor what the agent does to make sure it is what he has been hired to do. But this can be costly, too. It may be impossible to define the agent’s job in a way that can be monitored effectively. For instance, it is hard to know whether a manager who has expanded a firm through an acquisition that reduced its share price was pursuing his own empire-building interests or, say, was trying to maximise shareholder value but was unlucky.

Another way to lower agency costs, especially when monitoring is too expensive or too difficult, is to make the interests of the agent more like those of the principal. For instance, an increasingly common solution to the agency costs arising from the separation of ownership and management of public companies is to pay managers partly with shares and share options in the company. This gives the managers a powerful incentive to act in the interests of the owners by maximising shareholder value. But even this is not a perfect solution. Some managers with lots of share options have engaged in accounting fraud in order to increase the value of those options long enough for them to cash some of them in, but to the detriment of their firm and its other shareholders. See, for example, Enron.

Agricultural policy

Countries often provide support for their farmers using trade barriers and subsidy because, for example:

*domestic agriculture, even if it is inefficient by world standards, can be an insurance policy in case it becomes difficult (as it does, for example, in wartime) to buy agricultural produce from abroad;

*farmers groups have proved adept at lobbying;

*politicians have sought to slow the depopulation of rural areas;

*agricultural prices can be volatile, as a result of unpredictable weather, among other things; and

*financial support can provide a safety net in unexpectedly severe market conditions.

Broadly speaking, governments have tried two methods of subsidising agriculture. The first, used in the United States during the 1930s and in the UK before it joined the European Union, is to top up farmers’ incomes if they fall below a level deemed acceptable. Farmers may be required to set aside some of their land in return for this support. The second is to guarantee a minimum level of farm prices by buying up surplus supply and storing or destroying it if prices would otherwise fall below the guaranteed levels. This was the approach adopted by the EU when it set up its Common Agricultural Policy. To keep down the direct cost of this subsidy the EU used trade barriers, including import levies, to minimise competition to EU farmers from produce available more cheaply on world agriculture markets. Recent American farm-support policy has combined income top-ups and some guaranteed prices.

As most governments have become more committed to international trade, such agricultural policies have come under increasing attack, although the free trade rhetoric has often run far ahead of genuine reform. In 2003, rich countries together spent over $300 billion a year supporting their farmers, more than six times what they spent on foreign AID. Finding a way to end agricultural support had become by far the biggest remaining challenge for those trying to negotiate global free trade.

Agriculture

Farming around the world continues to become more productive while generally accounting for a smaller share of employment and national income, although in some poor countries it remains the sector on which the country and its people depend. Farming, forestry and fishing in 1913 accounted for 28% of employment in the United States, 41% in France and 60% in Japan, but only 12% in the UK. Now the proportion of the workforce employed in such activities has dropped below 6% in these and most other industrialised countries.

The total value of international trade in agriculture has risen steadily. But the global agriculture market remains severely distorted by trade barriers and government subsidy, such as the european union’s Common agricultural policy.

Aid

See international aid.

Altruism

It is often alleged that altruism is inconsistent with economic rationality, which assumes that people behave selfishly. Certainly, much economic analysis is concerned with how individuals behave, and homo economicus (economic man) is usually assumed to act in his or her self-interest. However, self-interest does not necessarily mean selfish. Some economic models in the field of behavioural economics assume that self-interested individuals behave altruistically because they get some benefit, or utility, from doing so. For instance, it may make them feel better about themselves, or be a useful insurance policy against social unrest, say. Some economic models go further and relax the traditional assumption of fully rational behaviour by simply assuming that people sometimes behave altruistically, even if this may be against their self-interest. Either way, there is much economic literature about charity, international aid, public spending and redistributive taxation.

Amortisation

The running down or payment of a loan by instalments. An example is a repayment mortgage on a house, which is amortised by making monthly payments that over a pre-agreed period of time cover the value of the loan plus interest. With loans that are not amortised, the borrower pays only interest during the period of the loan and then repays the sum borrowed in full.

Animal spirits

The colourful name that keynes gave to one of the essential ingredients of economic prosperity: confidence. According to Keynes, animal spirits are a particular sort of confidence, “naive optimism”. He meant this in the sense that, for entrepreneurs in particular, “the thought of ultimate loss which often overtakes pioneers, as experience undoubtedly tells us and them, is put aside as a healthy man puts aside the expectation of death”. Where these animal spirits come from is something of a mystery. Certainly, attempts by politicians and others to talk up confidence by making optimistic noises about economic prospects have rarely done much good.

Antitrust

government policy for dealing with monopoly. Antitrust laws aim to stop abuses of market power by big companies and, sometimes, to prevent corporate mergers and acquisitions that would create or strengthen a monopolist. There have been big differences in antitrust policies both among countries and within the same country over time. This has reflected different ideas about what constitutes a monopoly and, where there is one, what sorts of behaviour are abusive.

In the United States, monopoly policy has been built on the Sherman Antitrust Act of 1890. This prohibited contracts or conspiracies to restrain trade or, in the words of a later act, to monopolise commerce. In the early 20th century this law was used to reduce the economic power wielded by so-called “robber barons”, such as JP Morgan and John D. Rockefeller, who dominated much of American industry through huge trusts that controlled companies’ voting shares. Du Pont chemicals, the railroad companies and Rockefeller’s Standard Oil, among others, were broken up. In the 1970s the Sherman Act was turned (ultimately without success) against IBM, and in 1982 it secured the break-up of AT&T’s nationwide telecoms monopoly.

In the 1980s a more laissez-faire approach was adopted, underpinned by economic theories from the chicago school. These theories said that the only justification for antitrust intervention should be that a lack of competition harmed consumers, and not that a firm had become, in some ill-defined sense, too big. Some monopolistic activities previously targeted by antitrust authorities, such as predatory pricing and exclusive marketing agreements, were much less harmful to consumers than had been thought in the past. They also criticised the traditional method of identifying a monopoly, which was based on looking at what percentage of a market was served by the biggest firm or firms, using a measure known as the herfindahl-hirschman index. Instead, they argued that even a market dominated by one firm need not be a matter of antitrust concern, provided it was a contestable market.

In the 1990s American antitrust policy became somewhat more interventionist. A high-profile lawsuit was launched against Microsoft in 1998. The giant software company was found guilty of anti-competitive behaviour, which was said to slow the pace of innovation. However, fears that the firm would be broken up, signalling a far more interventionalist American antitrust policy, proved misplaced. The firm was not severely punished.

In the UK, antitrust policy was long judged according to what policymakers decided was in the public interest. At times this approach was comparatively permissive of mergers and acquisitions; at others it was less so. However, in the mid-1980s the UK followed the American lead in basing antitrust policy on whether changes in competition harmed consumers. Within the rest of the european union several big countries pursued policies of building up national champions, allowing chosen firms to enjoy some monopoly power at home which could be used to make them more effective competitors abroad. However, during the 1990s the European Commission became increasingly active in antitrust policy, mostly seeking to promote competition within the EU.

In 2000, the EU controversially blocked a merger between two American firms, GE and Honeywell; the deal had already been approved by America’s antitrust regulators. The controversy highlighted an important issue. As globalisation increases, the relevant market for judging whether market power exists or is being abused will increasingly cover far more territory than any one single economy. Indeed, there may be a need to establish a global antitrust watchdog, perhaps under the auspices of the world trade organisation.

Appreciation

A rise in the value of an asset and the opposite of depreciation. When the value of a currency rises relative to another, it appreciates.

Arbitrage

Buying an asset in one market and simultaneously selling an identical asset in another market at a higher price. Sometimes these will be identical assets in different markets, for instance, shares in a company listed on both the London Stock Exchange and New York Stock Exchange. Often the assets being arbitraged will be identical in a more complicated way, for example, they will be different sorts of financial securities that are each exposed to identical risks.

Some kinds of arbitrage are completely risk-free-this is pure arbitrage. For instance, if EUROS are available more cheaply in dollars in London than in New York, arbitrageurs (also known as arbs) can make a risk-free PROFIT by buying euros in London and selling an identical amount of them in New York. Opportunities for pure arbitrage have become rare in recent years, partly because of the GLOBALISATION of FINANCIAL MARKETS. Today, a lot of so called arbitrage, much of it done by hedge funds, involves assets that have some similarities but are not identical. This is not pure arbitrage and can be far from risk free.

Arbitrage pricing theory

This is one of two influential economic theories of how assets are priced in the financial markets. The other is the capital asset pricing model. The arbitrage pricing theory says that the price of a financial asset reflects a few key risk factors, such as the expected rate of interest, and how the price of the asset changes relative to the price of a portfolio of assets. If the price of an asset happens to diverge from what the theory says it should be, arbitrage by investors should bring it back into line.

Asian crisis

During 1997-98, many of the East Asian tiger economies suffered a severe finanical and economic crisis. This had big consequences for the global financial markets, which had become increasingly exposed to the promise that Asia had seemed to offer. The crisis destroyed wealth on a massive scale and sent absolute poverty shooting up. In the banking system alone, corporate loans equivalent to around half of one year’s GDP went bad – a destruction of savings on a scale more usually associated with a full-scale war. The precise cause of the crisis remains a matter of debate. Fingers have been pointed at the currency peg adopted by some countries, and a reduction of capital controls in the years before the crisis. Some blamed economic contagion. The crisis brought an end to a then widespread belief that there was a distinct “Asian way” of capitalism that might prove just as successful as capitalism in America or Europe. Instead, critics turned their fire on Asian cronyism, ill-disciplined banking and lack of transparency. In the years following the crisis, most of the countries involved have introduced reforms designed to increase transparency and improve the health of the banking system, although some (such as South Korea) went much further than others (such as Indonesia).

Assets

Things that have earning power or some other value to their owner.

Asymmetric information

When somebody knows more than somebody else. Such asymmetric information can make it difficult for the two people to do business together, which is why economists, especially those practising game theory, are interested in it. Transactions involving asymmetric (or private) information are everywhere. A government selling broadcasting licences does not know what buyers are prepared to pay for them; a lender does not know how likely a borrower is to repay; a used-car seller knows more about the quality of the car being sold than do potential buyers. This kind of asymmetry can distort people’s incentives and result in significant inefficiencies.

Asymmetric shock

When something unexpected happens that affects one economy (or part of an economy) more than the rest. This can create big problems for policymakers if they are trying to set a macroeconomic policy that works for both the area affected by the shock and the unaffected area. For instance, some economic areas may be oil exporters and thus highly dependent on the price of oil, but other areas are not. If the oil price plunges, the oil-dependent area would benefit from policies designed to boost demand that might be unsuited to the needs of the rest of the economy. This may be a constant problem for those responsible for setting the interest rate for the euro given the big differences–and different potential exposures to shocks–among the economies within the euro zone.

Auctions

Going, going, gone. Holding an auction can be an extremely efficient way for a seller to set the price of its products, especially if it does not have much information about how much people may be willing to pay for them. Auctions fascinate economists, especially those who specialise in game theory. They have long been a feature of the sale of art and antiques in the rooms of firms such as Sotheby’s and Christie’s. But in recent years they have played a growing role in other parts of the economy, ranging from the allocation of government-controlled broadcasting bandwidth to the awarding of work to subcontractors by governments and big firms using competitive tendering, and even more recently the sale of goods over the Internet.

An English auction is the most familiar. Bidders compete to offer higher prices and drop out until only one remains. In a Dutch auction, the auctioneer calls out a high price then keeps lowering it until there is a buyer. There are various forms of sealed bid auctions. In a first price sealed bid, each buyer submits a price in a sealed envelope and all bids are opened simultaneously, with the highest offer winning. In a second (or third, fourth, and so on) price sealed bid, the highest bidder wins but pays only the second (third, fourth) highest price bid.

An English or Dutch auction will work well for a seller if there is more than one serious bidder, as competition will ensure that the price is set at the level at which it is not worth more to any other bidder but the winner. Indeed, in a competitive auction the successful bidder may end up offering more than what is being auctioned is actually worth. This is known as the winner’s curse.

Which method will generate the best price for the seller depends on how many bidders take part and how well informed they are. Unfortunately for the seller, this information is not always available before the auction takes place.

Austrian economics

A brand of neo-classical economics established in Vienna during the late 19th century and the first half of the 20th century. It was strongly opposed to Marxism and, more broadly, to the use of economic theories to justify government intervention in the economy. Prominent members included Friedrich hayek, Joseph schumpeter and Ludwig von Mises. It gave birth to the definition of economics as the science of studying human behaviour as a relationship between ends and scarce means that have alternative uses. Austrian economic thinking was characterised by attributing all economic activity, including the behaviour of apparently impersonal institutions, to the wishes and actions of individuals. It did this by examining choices in terms of their opportunity cost (that is, what is the next best use of resources to that which is being considered?) and by analysing the impact of timing on decision making.

Hayek correctly predicted the failure of Soviet-style central planning. His ideas are said to have inspired many of the free-market reforms carried out during the 1980s in the United States under Ronald Reagan and in the UK under Margaret Thatcher. Schumpeter developed a theory of innovation and economic change characterised by the phrase creative destruction.

Autarky

The idea that a country should be self-sufficient and not take part in international trade. The experience of countries that have pursued this Utopian ideal by substituting domestic production for imports is an unhappy one. No country has been able to produce the full range of goods demanded by its population at competitive prices. Indeed, those that have tried to do so have condemned themselves to inefficiency and comparative poverty, compared with countries that engage in international trade.

Average

A number that is calculated to summarise a group of numbers. The most commonly used average is the mean, the sum of the numbers divided by however many numbers there are in the group. The median is the middle value in a group of numbers ranked in order of size. The mode is the number that occurs most often in a group of numbers. Take the following group of numbers: 1, 2, 2, 9, 12, 13, 17

The mean is 56/7=8,

The median is 9,

The mode is 2

Backwardation

Balance of payments

Balanced budget

Bank

Bankruptcy

Barriers to entry (or exit)

Barter

Basel 1 and 2

Basis point

Bear

Behavioural economics

Beta

Big Mac index

Black economy

Black-Scholes

Bonds

Boom and bust

Bounded rationality

Brand

Bretton Woods

Bubble

Budget

Bull

Business confidence

Business cycle

Buyer’s market

Backwardation

When a commodity is valued more highly in a spot market (that is, when it is for delivery today) than in a futures market (for delivery at some point in the future). Normally, interest costs mean that futures prices are higher than spot prices, unless the markets expect the price of the commodity to fall over time, perhaps because there is a temporary bottleneck in supply. When spot prices are lower than futures prices it is known as contango.

Balance of payments

The total of all the money coming into a country from abroad less all of the money going out of the country during the same period. This is usually broken down into the current account and the capital account. The current account includes:

*visible trade (known as merchandise trade in the United States), which is the value of exports and imports of physical goods;

*invisible trade, which is receipts and payments for services, such as banking or advertising, and other intangible goods, such as copyrights, as well as cross-border dividend and interest payments;

*private transfers, such as money sent home by expatriate workers;

*official transfers, such as international aid.

The capital account includes:

*long-term capital flows, such as money invested in foreign firms, and profits made by selling those investments and bringing the money home;

*short-term capital flows, such as money invested in foreign currencies by international speculators, and funds moved around the world for business purposes by multinational companies. These short-term flows can lead to sharp movements in exchange rates, which bear little relation to what currencies should be worth judging by fundamental measures of value such as purchasing power parity.

As bills must be paid, ultimately a country’s accounts must balance (although because real life is never that neat a balancing item is usually inserted to cover up the inconsistencies).

“Balance of payments crisis” is a politically charged phrase. But a country can often sustain a current account deficit for many years without its economy suffering, because any deficit is likely to be tiny compared with the country’s national income and wealth. Indeed, if the deficit is due to firms importing technology and other capital goods from abroad, which will improve their productivity, the economy may benefit. A deficit that has to be financed by the public sector may be more problematic, particularly if the public sector faces limits on how much it can raise taxes or borrow or has few financial reserves. For instance, when the Russian government failed to pay the interest on its foreign debt in August 1998 it found it impossible to borrow any more money in the international financial markets. Nor was it able to increase taxes in its collapsing economy or to find anybody within Russia willing to lend it money. That truly was a balance of payments crisis.

In the early years of the 21st century, economists started to worry that the United States would find itself in a balance of payments crisis. Its current account deficit grew to over 5% of its GDP, making its economy increasingly reliant on foreign credit.

Balanced budget

When total public-sector spending equals total government income during the same period from taxes and charges for public services. Politicians in some countries, such as the United States, have argued that government should be required to run a balanced budget in order to have sound public finances. However, there is no economic reason why public borrowing need necessarily be bad. For instance, if the debt is used to invest in things that will increase the growth rate of the economy–infrastructure, say, or education–it may be justified. It may also make more economic sense to try to balance the budget on average over an entire economic cycle, with public-sector deficits boosting the economy during recession and surpluses stopping it overheating during booms, than to balance it every year.

Bank

Starting out as places that would guard your money, banks became the main source of credit creation. Increasingly, however, borrowers are turning to the financial markets and to non-savings institutions, such as credit-card companies and consumer-finance firms, when they need a loan. This is reducing the profitability of traditional bank lending and has led many banks to enter new areas of business, such as selling insurance policies and mutual funds. Increasingly, too, traditional banks are selling off parcels of their loans in the financial markets by a process called securitisation.

What the most efficient split is between bank lending and other sorts of lending is debatable. Economists argue endlessly about whether an economy such as the United States, in which firms rely more heavily on the equity and debt markets than on banks to fund their investment, is better than one such as, say, Germany, in which banks have traditionally been the main source of corporate finance.

Banks come in many different forms. Commercial banks, also known as retail banks, cater directly for the general public and lend to (mostly small and medium-sized) firms. In the past, they did so largely through a network of bank branches, although increasingly these are giving way to atm machines, the telephone and the Internet. Wholesale banks largely transact with other banks and financial institutions. Investment banks, also known as merchant banks, concentrate on raising money for companies from private investors or in the financial markets, by finding buyers for their equity and corporate bonds. Universal banks do most or all of the above including, through bancassurance, selling insurance. These banks have long been a feature of continental European economies. However, in the United States financial laws such as the Glass-Steagall Act have separated different forms of banking from each other and kept banks out of the insurance business. These laws were abolished in 1999, although during the preceding couple of decades regulators effectively dismantled them by changing the way they were applied. Even so, because of these and other laws, which for many years stopped banks from operating across state borders, the United States has far more lending institutions than other countries. In 2003 there were over four lending institutions per 100,000 people in the United States, compared with fewer than one per 100,000 in the UK and France.

Bankruptcy

When a court judges that a debtor is unable to make the payments owed to a creditor. How bankrupts are treated can affect economic growth. If bankrupts are punished too severely, would-be entrepreneurs may be discouraged from taking the financial risks needed to make the most of their ideas. However, letting off defaulting debtors too readily may discourage potential creditors because of moral hazard.

America’s bankruptcy code, in particular its Chapter 11 protection for firms from their creditors, is particularly friendly to troubled borrowers, allowing them to borrow more money and giving them time to work out their problems. Some other countries quickly close down a bankrupt firm, and try to repay its debts by selling off any assets it has.

Barriers to entry (or exit)

How firms keep out competition–an important source of incumbent advantage. There are four main sorts of barriers.

*A firm may own a crucial resource, such as an oil well, or it may have an exclusive operating licence, for instance, to broadcast on a particular radio wavelength.

*A big firm with economies of scale may have a significant competitive advantage because it can produce a large output at lower costs than can a smaller potential rival.

*An incumbent firm may make it hard for a would-be entrant by incurring huge sunk costs, spending lots of money on things such as advertising, which any rival must match to compete effectively but which have no value if the attempt to compete should fail.

*Powerful firms can discourage entry by raising exit costs, for example, by making it an industry norm to hire workers on long-term contracts, which make firing an expensive process.

Barter

Paying for goods or services with other goods or services, instead of with money. It is often popular when the quality of money is low or uncertain, perhaps because of high inflation or counterfeiting, or when people are asset-rich but cash-poor, or when taxation or extortion by criminals is high. Little wonder, then, that barter became popular in Russia during the late 1990s.

Basel 1 and 2

An attempt to reduce the number of bank failures by tying a bank’s capital adequacy ratio to the riskiness of the loans it makes. For instance, there is less chance of a loan to a government going bad than a loan to, say, an internet business, so the bank should not have to hold as much capital in reserve against the first loan as against the second. The first attempt to do this worldwide was by the Basel committee for international banking supervision in 1988. However, its system of judging the relative riskiness of different loans was crude. For instance, it penalised banks no more for making loans to a fly-by-night software company in Thailand than to Microsoft; no more for loans to South Korea, bailed out by the IMF in 1998, than to Switzerland. In 1998, “Basel 2” was proposed, using much more sophisticated risk classifications. However, controversy over these new classifications, and the cost to banks of administering the new approach, led to the introduction of Basel 2 being delayed until (at least) 2005.

Basis point

One one-hundredth of a percentage point. Small movements in the interest rate, the exchange rate and bond yields are often described in terms of basis points. If a bond yield moves from 5.25% to 5.45%, it has risen by 20 basis points.

Bear

An investor who thinks that the price of a particular security or class of securities (shares, say) is going to fall; the opposite of a bull.

Behavioural economics

A branch of economics that concentrates on explaining the economic decisions people make in practice, especially when these conflict with what conventional economic theory predicts they will do. Behaviourists try to augment or replace traditional ideas of economic rationality (homo economicus) with decision-making models borrowed from psychology. According to psychologists, people are disproportionately influenced by a fear of feeling regret and will often forgo benefits even to avoid only a small risk of feeling they have failed. They are also prone to cognitive dissonance, often holding on to a belief plainly at odds with new evidence, usually because the belief has been held and cherished for a long time. Then there is anchoring: people are often overly influenced by outside suggestion. People apparently also suffer from status quo bias: they are willing to take bigger gambles to maintain the status quo than they would be to acquire it in the first place.

Traditional utility theory assumes that people make individual decisions in the context of the big picture. But psychologists have found that they generally compartmentalise, often on superficial grounds. They then make choices about things in one particular mental compartment without taking account of the implications for things in other compartments.

There is lots of evidence that people are persistently and irrationally overconfident. They are also vulnerable to hindsight bias: once something happens they overestimate the extent to which they could have predicted it. Many of these traits are captured in prospect theory, which is at the heart of much of behavioural economics.

Beta

Part of an economic theory for valuing financial securities and calculating the cost of capital, known as the capital asset pricing model, beta measures the sensitivity of the price of a particular asset to changes in the market as a whole. If a company’s shares have a beta of 0.8 it implies that on average the share price will change by 0.8% if there is a 1% change in the market. There is a long-running debate about whether a beta calculated from a security’s past relationship with the market actually predicts how that relationship will behave in future, leading some doubting economists to claim that beta is “dead”.

Big Mac index

The Big Mac index was devised by Pam Woodall of The Economist in 1986, as a light-hearted guide to whether currencies are at their “correct” level. It is based on one of the oldest concepts in international economics, purchasing power parity (PPP), the notion that a dollar, say, should buy the same amount in all countries. In the long run, argue ppp fans, currencies should move towards the exchange rate, which equalises the prices of an identical basket of goods and services in each country. In this case, the basket is a McDonalds’ Big Mac, which is produced in more than 100 countries. The Big Mac PPP is the exchange rate that would leave hamburgers costing the same in the United States as elsewhere. Comparing actual exchange rates with PPP signals whether a currency is undervalued or overvalued. Some studies have found that the Big Mac index is often a better predictor of currency movements than more theoretically rigorous models.

Black economy

If you pay your cleaner or builder in cash, or for some reason neglect to tell the taxman that you were paid for a service rendered, you participate in the black or underground economy. Such transactions do not normally show up in the figures for GDP, so the black economy may mean that a country is much richer than the official data suggest. In the United States and the UK, the black economy adds an estimated 5-10% to GDP; in Italy, it may add 30%. As for Russia, in the late 1990s estimates of the black economy ranged as high as 50% of GDP.

Black-Scholes

A formula for pricing financial options. Its invention allowed a previously undreamed of precision in the pricing of options (which had hitherto been done using crude rules of thumb), and probably made possible the explosive growth in the markets for options and other derivatives that took place after the formula became widely used in the early 1970s. Myron Scholes and Robert Merton were awarded the nobel prize for economics for their part in devising the formula; their co-inventor, Fischer Black (1938-95), was ineligible, having died.

Bonds

Gentlemen prefer bonds, punned Andrew Mellon, an American tycoon. A bond is an interest-bearing security issued by governments, companies and some other organisations. Bonds are an alternative way for the issuer to raise capital to selling shares or taking out a bank loan. Like shares in listed companies, once they have been issued bonds may be traded on the open market. A bond’s yield is the interest rate (or coupon) paid on the bond divided by the bond’s market price. Bonds are regarded as a lower risk investment. government bonds, in particular, are highly unlikely to miss their promised payments. Corporate bonds issued by blue-chip “investment grade” companies are also unlikely to default; this might not be the case with high-yield “junk” bonds issued by firms with less healthy financials. (See yield curve.)

Boom and bust

See business cycle.

Bounded rationality

A theory of human decision making that assumes that people behave rationally, but only within the limits of the information available to them. Because their information may be inadequate (bounded) they make take decisions that appear to be irrational according to traditional theories about homo economicus (economic man). (See also behavioural economics.)

Brand

The stalking-horse for international capitalism. A focus for all the worries about environmental damage, human-rights abuses and sweated labour that opponents of globalisation like to put on their placards. A symbol of America’s corporate power, since most of the world’s best-known brands, from Coca Cola to Nike, are American. That is the case against.

Many economists regard brands as a good thing, however. A brand provides a guarantee of reliability and quality. Consumer trust is the basis of all brand values. So companies that own the brands have an immense incentive to work to retain that trust. Brands have value only where consumers have choice. The arrival of foreign brands, and the emergence of domestic brands, in former communist and other poorer countries points to an increase in competition from which consumers gain. Because a strong brand often requires expensive advertising and good marketing, it can raise both price and barriers to entry. But not to insurperable levels: brands fade as tastes change; if quality is not maintained, neither is the brand.

Bretton Woods

A conference held at Bretton Woods, New Hampshire, in 1944, which designed the structure of the international monetary system after the second world war and set up the imf and the world bank. It was agreed that the exchange rates of IMF members would be pegged to the dollar, with a maximum variation of 1% either side of the agreed rate. Rates could be adjusted more sharply only if a country’s balance of payments was in fundamental disequilibrium. In August 1971 economic troubles and the cost of financing the Vietnam war led the American president, Richard Nixon, to devalue the dollar. This shattered confidence in the fixed exchange rate system and by 1973 all of the main currencies were floating freely, at rates set mostly by market forces rather than government fiat.

Bubble

When the price of an asset rises far higher than can be explained by fundamentals, such as the income likely to derive from holding the asset. The Chicago Tribune of April 13th 1890, writing about the then mania in real-estate prices, described “men who bought property at prices they knew perfectly well were fictitious, but who were prepared to pay such prices simply because they knew that some still greater fool could be depended on to take the property off their hands and leave them with a profit”. Such behaviour is a feature of all bubbles.

Famous bubbles include tulip mania in Holland during the 17th century, when the prices of tulip bulbs reached unheard of levels, and the South Sea Bubble in Britain a century later, although there have been many others since, including the dotcom bubble in internet company shares that burst in 2000. Economists argue about whether bubbles are the result of irrational crowd behaviour (perhaps coupled with exploitation of the gullible masses by some savvy speculators) or, instead, are the result of rational decisions by people who have only limited information about the fundamental value of an asset and thus for whom it may be quite sensible to assume the market price is sound. Whatever their cause, bubbles do not last forever and often end not with a pop but with a crash.

Budget

An annual procedure to decide how much public spending there should be in the year ahead and what mix of taxation, charging for services and borrowing should finance it. The budgeting process differs enormously from one country to another. In the United States, for example, the president proposes a budget in February for the fiscal year starting the following October, but this has to be approved by Congress. By the time a final decision has to be made, ideally, no later than September, there are often three competing versions: the president’s latest proposal, one from the Senate and another from the House of Representatives. What finally emerges is the result of last-minute negotiations. Occasionally, delays in agreeing the budget have led to the temporary closure of some federal government offices. Contrast this with the UK, where most of what the government proposes is usually approved by parliament, and some changes take effect as soon as they are announced (subject to subsequent parliamentary vote).

Bull

An investor who expects the price of a particular security to rise; the opposite of a bear.

Business confidence

How the people who run companies feel about their organisations’ prospects. In many countries, surveys measure average business confidence. These can provide useful signs about the current condition of the economy, because companies often have information about consumer demand sooner than government statisticians do.

Business cycle

Boom and bust. The long-run pattern of economic growth and recession. According to the Centre for International Business Cycle Research at Columbia University, between 1854 and 1945 the average expansion lasted 29 months and the average contraction 21 months. Since the second world war, however, expansions have lasted almost twice as long, an average of 50 months, and contractions have shortened to an average of only 11 months. Over the years, economists have produced numerous theories of why economic activity fluctuates so much, none of them particularly convincing. A Kitchin cycle supposedly lasted 39 months and was due to fluctuations in companies’ inventories. The Juglar cycle would last 8-9 years as a result of changes in investment in plant and machinery. Then there was the 20-year Kuznets cycle, allegedly driven by house-building, and, perhaps the best-known theory of them all, the 50-year kondratieff wave. hayek tangled with keynes over what caused the business cycle, and won the nobel prize for economics for his theory that variations in an economy’s output depended on the sort of capital it had. Taking a quite different tack, in the late 1960s Arthur Okun, an economic adviser to presidents Kennedy and Johnson, proclaimed that the business cycle was “obsolete”. A year later, the American economy was in recession. Again, in the late 1990s, some economists claimed that technological innovation and globalisation meant that the business cycle was a thing of the past. Alas, they were soon proved wrong.

Buyer’s market

A market in which supply seems plentiful and prices seem low; the opposite of a seller’s market.

Cannibalise

Capacity

Capital

Capital adequacy ratio

Capital asset pricing model

Capital controls

Capital flight

Capital gains

Capital intensive

Capital markets

Capital structure

Capitalism

CAPM

Cartel

Catch-up effect

Central bank

Ceteris paribus

Charity

Chicago School

Classical dichotomy

Classical economics

Closed economy

Coase theorem

Collateral

Collusion

Command economy

Commoditisation

Commodity

Common goods

Communism

Comparative advantage

Competition

Competitive advantage

Competitiveness

Complementary goods

Compound interest

Concentration

Conditionality

Consumer confidence

Consumer prices

Consumer surplus

Consumption

Contagion

Contestable market

Convergence

Corruption

Cost of capital

Cost-benefit analysis

Creative destruction

Credit

Credit creation

Credit crunch

Creditor

Crony capitalism

Crowding out

Currency board

Currency peg

Current account

Cannibalise

Eating people is wrong. Eating your own business may not be. FIRMS used to be reluctant to launch new products and SERVICES that competed with what they were already doing, as the new thing would eat into (cannibalise) their existing business. In today’s innovative, technology-intensive economy, however, a willingness to cannibalise is more often seen as a good thing. This is because INNOVATION often takes the form of what economists call creative destruction (see SCHUMPETER), in which a superior new product destroys the market for existing products. In this environment, the best course of action for successful firms that want to avoid losing their market to a rival with an innovation may be to carry out the creative destruction themselves.

Capacity

The amount a company or an economy can produce using its current equipment, workers, CAPITAL and other resources at full tilt. Judging how close an economy is to operating at full capacity is an important ingredient of MONETARY POLICY, for if there is not enough spare capacity to absorb an increase in DEMAND, PRICES are likely to rise instead. Measuring an economy’s OUTPUT GAP – how far current OUTPUT is above or below what it would be at full capacity – is difficult, if not impossible, which is why even the best-intentioned CENTRAL BANK can struggle to keep down INFLATION. When there is too much spare capacity, however, the result can be DEFLATION, as FIRMS and employees cut their prices and wage demands to compete for whatever demand there may be.

Capital

MONEY or assets put to economic use, the life-blood of CAPITALISM. Economists describe capital as one of the four essential ingredients of economic activity, the FACTORS OF PRODUCTION, along with LAND, LABOUR and ENTERPRISE. Production processes that use a lot of capital relative to labour are CAPITAL INTENSIVE; those that use comparatively little capital are LABOUR INTENSIVE. Capital takes different forms. A firm’s ASSETS are known as its capital, which may include fixed capital (machinery, buildings, and so on) and working capital (stocks of raw materials and part-finished products, as well as money, that are used up quickly in the production process). Financial capital includes money, BONDS and SHARES. HUMAN CAPITAL is the economic wealth or potential contained in a person, some of it endowed at birth, the rest the product of training and education, if only in the university of life. The invisible glue of relationships and institutions that holds an economy together is its social capital.

Capital adequacy ratio

The ratio of a BANK’s CAPITAL to its total ASSETS, required by regulators to be above a minimum (“adequate”) level so that there is little RISK of the bank going bust. How high this minimum level is may vary according to how risky a bank’s activities are.

Capital asset pricing model

A method of valuing ASSETS and calculating the COST OF CAPITAL (for an alternative, see ARBITRAGE PRICING THEORY). The capital asset pricing model (CAPM) has come to dominate modern finance.

The rationale of the CAPM can be simplified as follows. Investors can eliminate some sorts of RISK, known as RESIDUAL RISK or alpha, by holding a diversified portfolio of assets (see MODERN PORTFOLIO THEORY). These alpha risks are specific to an individual asset, for example, the risk that a company’s managers will turn out to be no good. Some risks, such as that of a global RECESSION, cannot be eliminated through diversification. So even a basket of all of the SHARES in a stockmarket will still be risky. People must be rewarded for investing in such a risky basket by earning returns on AVERAGE above those that they can get on safer assets, such as TREASURY BILLS. Assuming investors diversify away alpha risks, how an investor values any particular asset should depend crucially on how much the asset’s PRICE is affected by the risk of the market as a whole. The market’s risk contribution is captured by a measure of relative volatility, BETA, which indicates how much an asset’s price is expected to change when the overall market changes.

Safe investments have a beta close to zero: economists call these assets risk free. Riskier investments, such as a share, should earn a premium over the risk-free rate. How much is calculated by the average premium for all assets of that type, multiplied by the particular asset’s beta.

But does the CAPM work? It all comes down to beta, which some economists have found of dubious use. They think the CAPM may be an elegant theory that is no good in practice. Yet it is probably the best and certainly the most widely used method for calculating the cost of capital.

Capital controls

government-imposed restrictions on the ability of CAPITAL to move in or out of a country. Examples include limits on foreign INVESTMENT in a country’s FINANCIAL MARKETS, on direct investment by foreigners in businesses or property, and on domestic residents’ investments abroad. Until the 20th century capital controls were uncommon, but many countries then imposed them. Following the end of the second world war only Switzerland, Canada and the United States adopted open capital regimes. Other rich countries maintained strict controls and many made them tougher during the 1960s and 1970s. This changed in the 1980s and early 1990s, when most developed countries scrapped their capital controls.

The pattern was more mixed in developing countries. Latin American countries imposed lots of them during the debt crisis of the 1980s then scrapped most of them from the late 1980s onwards. Asian countries began to loosen their widespread capital controls in the 1980s and did so more rapidly during the 1990s.

In developed countries, there were two main reasons why capital controls were lifted: free markets became more fashionable and financiers became adept at finding ways around the controls. Developing countries later discovered that foreign capital could play a part in financing domestic investment, from roads in Thailand to telecoms systems in Mexico, and, furthermore, that financial capital often brought with it valuable HUMAN CAPITAL. They also found that capital controls did not work and had unwanted side-effects. Latin America’s controls in the 1980s failed to keep much money at home and also deterred foreign investment.

The Asian economic crisis and CAPITAL FLIGHT of the late 1990s revived interest in capital controls, as some Asian governments wondered whether lifting the controls had left them vulnerable to the whims of international speculators, whose money could flow out of a country as fast as it once flowed in. There was also discussion of a ‘Tobin tax’ on short-term capital movements, proposed by James TOBIN, a winner of the NOBEL PRIZE FOR ECONOMICS. Even so, they mostly considered only limited controls on short-term capital movements, particularly movements out of a country, and did not reverse the broader 20-year-old process of global financial and economic LIBERALISATION.

Capital flight

When CAPITAL flows rapidly out of a country, usually because something happens which causes investors suddenly to lose confidence in its economy. (Strictly speaking, the problem is not so much the MONEY leaving, but rather that investors in general suddenly lower their valuation of all the assets of the country.) This is particularly worrying when the flight capital belongs to the country’s own citizens. This is often associated with a sharp fall in the EXCHANGE RATE of the abandoned country’s currency.

Capital gains

The PROFIT from the sale of a capital ASSET, such as a SHARE or a property. Capital gains are subject to TAXATION in most countries. Some economists argue that capital gains should be taxed lightly (if at all) compared with other sources of INCOME. They argue that the less tax is levied on capital gains, the greater is the incentive to put capital to productive use. Put another way, capital gains tax is effectively a tax on CAPITALISM. However, if capital gains are given too friendly a treatment by the tax authorities, accountants will no doubt invent all sorts of creative ways to disguise other income as capital gains.

Capital intensive

A production process that involves comparatively large amounts of CAPITAL; the opposite of LABOUR INTENSIVE.

Capital markets

Markets in SECURITIES such as BONDS and SHARES. Governments and companies use them to raise longer-term CAPITAL from investors, although few of the millions of capital-market transactions every day involve the issuer of the security. Most trades are in the SECONDARY MARKETS, between investors who have bought the securities and other investors who want to buy them. Contrast with MONEY MARKETS, where short-term capital is raised.

Capital structure

The composition of a company’s mixture of DEBT and EQUITY financing. A firm’s debt-equity ratio is often referred to as its GEARING. Taking on more debt is known as gearing up, or increasing lever age. In the 1960s, Franco Modigliani and Merton Miller (1923–2000) published a series of articles arguing that it did not matter whether a company financed its activities by issuing debt, or equity, or a mixture of the two. (For this they were awarded the NOBEL PRIZE FOR ECONOMICS.) But, they said, this rule does not apply if one source of financing is treated more favourably by the taxman than another. In the United States, debt has long had tax advantages over equity, so their theory implies that American FIRMS should finance themselves with debt. Companies also finance themselves by using the PROFIT they retain after paying dividends.

Capitalism

The winner, at least for now, of the battle of economic ‘isms’. Capitalism is a free-market system built on private ownership, in particular, the idea that owners of CAPITAL have PROPERTY RIGHTS that entitle them to earn a PROFIT as a reward for putting their capital at RISK in some form of economic activity. Opinion (and practice) differs considerably among capitalist countries about what role the state should play in the economy. But everyone agrees that, at the very least, for capitalism to work the state must be strong enough to guarantee property rights. According to Karl MARX, capitalism contains the seeds of its own destruction, but so far this has proved a more accurate description of Marx’s progeny, COMMUNISM.

CAPM

See CAPITAL ASSET PRICING MODEL.

Cartel

An agreement among two or more FIRMS in the same industry to co-operate in fixing PRICES and/or carving up the market and restricting the amount of OUTPUT they produce. It is particularly common when there is an OLIGOPOLY. The aim of such collusion is to increase PROFIT by reducing COMPETITION. Identifying and breaking up cartels is an important part of the competition policy overseen by ANTITRUST watchdogs in most countries, although proving the existence of a cartel is rarely easy, as firms are usually not so careless as to put agreements to collude on paper. The desire to form cartels is strong. As Adam SMITH put it, ‘People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public or in some contrivance to raise prices.’

Catch-up effect

In any period, the economies of countries that start off poor generally grow faster than the economies of countries that start off rich. As a result, the NATIONAL INCOME of poor countries usually catches up with the national income of rich countries. New technology may even allow DEVELOPING COUNTRIES to leap-frog over industrialised countries with older technology. This, at least, is the traditional economic theory. In recent years, there has been considerable debate about the extent and speed of convergence in reality.

One reason to expect catch-up is that workers in poor countries have little access to CAPITAL, so their PRODUCTIVITY is often low. Increasing the amount of capital at their disposal by only a small amount can produce huge gains in productivity. Countries with lots of capital, and as a result higher levels of productivity, would enjoy a much smaller gain from a similar increase in capital. This is one possible explanation for the much faster GROWTH of Japan and Germany, compared with the United States and the UK, after the second world war and the faster growth of several Asian ‘tigers’, compared with developed countries, during the 1980s and most of the 1990s.

Central bank

A guardian of the monetary system. A central bank sets short-term INTEREST RATES and oversees the health of the FINANCIAL SYSTEM, including by acting as LENDER OF LAST RESORT to commercial banks that get into financial difficulties. The Federal Reserve, the central bank of the United States, was founded in 1913. The Bank of England, known affectionately as the ‘Old Lady of Threadneedle Street’, was established in 1694, 26 years after the creation of the world’s first central bank in Sweden. With the birth of the EURO in 1999, the MONETARY POLICY powers of the central banks of 11 European countries were transferred to a new EUROPEAN CENTRAL BANK, based in Frankfurt.

During the 1990s there was a trend to make central banks independent from political intervention in their day-to-day operations and allow them to set interest rates. Independent central banks should be able to concentrate on the long-term needs of an economy, whereas political intervention may be guided by the short-term needs of the GOVERNMENT. In theory, an independent central bank should reduce the risk of INFLATION. Some central banks are legally requried to set interest rates so as to hit an explicit inflation target. Politicians are often tempted to exploit a possible short-term trade-off between inflation and UNEMPLOYMENT, even though the long-term consequence of easing policy in this way is (most economists say) that the unemployment rate returns to what you started with and inflation is higher. An independent central bank, because it does not have to worry about persuading an electorate to vote for it, is more likely to act in the best long-run interests of the economy.

Ceteris paribus

Other things being equal. Economists use this Latin phrase to cover their backs. For example, they might say that “higher interest rates will lead to lower inflation, ceteris paribus”, which means that they will stand by their prediction about INFLATION only if nothing else changes apart from the rise in the INTEREST RATE.

Charity

“Bah! Humbug”, was Scrooge’s opinion of charitable giving. Some economists reckon charity goes against economic rationality. Some have argued that the popularity of charitable giving is proof that people are not economically rational. Others argue that it shows that ALTRUISM is something that people get pleasure (UTILITY) from, and so are willing to spend some of their INCOME on it. An interesting question is the extent to which the state is competing with private charity when it redistributes money from rich to poor or spends more on health care and whether this is inefficient.

Chicago School

A fervently free-market economic philosophy long associated with the University of Chicago. At times, especially when KEYNESIAN ECONOMICS was the orthodoxy in much of the world, the Chicago School was regarded as a bastion of unworldly extremism. However, from the late 1970s it came to be regarded as mainstream by many and Chicago trained economists often played a crucial part in the implementation of policies of low INFLATION and market LIBERALISATION that swept the world during the 1980s and 1990s. By 2003, boasted the University of Chicago, some 22 of the 49 then winners of the NOBEL PRIZE FOR ECONOMICS had been faculty members, students or researchers there.

Classical dichotomy

See MONETARY NEUTRALITY.

Classical economics

The dominant theory of economics from the 18th century to the 20th century, when it evolved into NEO-CLASSICAL ECONOMICS. Classical economists, who included Adam SMITH, David RICARDO and John Stuart Mill, believed that the pursuit of individual self-interest produced the greatest possible economic benefits for society as a whole through the power of the INVISIBLE HAND. They also believed that an economy is always in EQUILIBRIUM or moving towards it.

Equilibrium was ensured in the LABOUR market by movements in WAGES and in the CAPITAL market by changes in the rate of INTEREST. The INTEREST RATE ensured that total SAVINGS in an economy were equal to total INVESTMENT. In DISEQUILIBRIUM, higher interest rates encouraged more saving and less investment, and lower rates meant less saving and more investment. When the DEMAND for labour rose or fell, wages would also rise or fall to keep the workforce at FULL EMPLOYMENT.

In the 1920s and 1930s, John Maynard KEYNES attacked some of the main beliefs of classical and neo-classical economics, which became unfashionable. In particular, he argued that the rate of interest was determined or influenced by the speculative actions of investors in BONDS and that wages were inflexible downwards, so that if demand for labour fell, the result would be higher UNEMPLOYMENT rather than cheaper workers.

Closed economy

An economy that does not take part in international trade; the opposite of an OPEN ECONOMY. At the turn of the century about the only notable example left of a closed economy is North Korea (see AUTARKY).

Coase theorem

See EXTERNALITY.

Collateral

An ASSET pledged by a borrower that may be seized by a lender to recover the value of a loan if the borrower fails to meet the required INTEREST charges or repayments.

Collusion

See CARTEL.

Command economy

When a GOVERNMENT controls all aspects of economic activity (see, for example, COMMUNISM).

Commoditisation

The process of becoming a COMMODITY. Microchips, for example, started out as a specialised technical innovation, costing a lot and earning their makers a high PROFIT on each chip. Now chips are largely homogeneous: the same chip can be used for many things, and any manufacturer willing to invest in some fairly standardised equip ment can make them. As a result, COMPETITION is fierce and PRICES and profit margins are low. Some economists argue that in today’s economy the faster pace of innovation will make the process of commoditisation increasingly common.

Commodity

A comparatively homogeneous product that can typically be bought in bulk. It usually refers to a raw material – oil, cotton, cocoa, silver – but can also describe a manufactured product used to make other things, for example, microchips used in personal computers. Commodities are often traded on commodity exchanges. On AVERAGE, the PRICE of natural commodities has fallen steadily in REAL TERMS in defiance of some predictions that growing CONSUMPTION of non-renewables such as copper would force prices up. At times the oil price has risen sharply in real terms, most notably during the 1970s, but this was due not to the exhaustion of limited supplies but to rationing by the OPEC CARTEL, or war, or fear of it, particularly in the oil-rich Middle East.

Common goods

See TRAGEDY OF THE COMMONS.

Communism

The enemy of CAPITALISM and now nearly extinct. Invented by KARL MARX, who predicted that feudalism and capitalism would be succeeded by the ‘dictatorship of the proletariat’, during which the state would ‘wither away’ and economic life would be organised to achieve ‘from each according to his abilities, to each according to his needs’. The Soviet Union was the most prominent attempt to put communism into practice and the result was conspicuous failure, although some modern followers of Marx reckon that the Soviets missed the point.

Comparative advantage

Paul Samuelson, one of the 20th century’s greatest economists, once remarked that the principle of comparative advantage was the only big idea that ECONOMICS had produced that was both true and surprising. It is also one of the oldest theories in economics, usually ascribed to DAVID RICARDO. The theory underpins the economic case for FREE TRADE. But it is often misunderstood or misrepresented by opponents of free trade. It shows how countries can gain from trading with each other even if one of them is more efficient – it has an ABSOLUTE ADVANTAGE – in every sort of economic activity. Comparative advantage is about identifying which activities a country (or firm or individual) is most efficient at doing.

To see how this theory works imagine two countries, Alpha and Omega. Each country has 1,000 workers and can make two goods, computers and cars. Alpha’s economy is far more productive than Omega’s. To make a car, Alpha needs two workers, compared with Omega’s four. To make a computer, Alpha uses 10 workers, compared with Omega’s 100. If there is no trade, and in each country half the workers are in each industry, Alpha produces 250 cars and 50 computers and Omega produces 125 cars and 5 computers.

What if the two countries specialise? Although Alpha makes both cars and computers more efficiently than Omega (it has an absolute advantage), it has a bigger edge in computer making. So it now devotes most of its resources to that industry, employing 700 workers to make computers and only 300 to make cars. This raises computer output to 70 and cuts car production to 150. Omega switches entirely to cars, turning out 250.

World output of both goods has risen. Both countries can consume more of both if they trade, but at what PRICE? Neither will want to import what it could make more cheaply at home. So Alpha will want at least 5 cars per computer, and Omega will not give up more than 25 cars per computer. Suppose the terms of trade are fixed at 12 cars per computer and 120 cars are exchanged for 10 computers. Then Alpha ends up with 270 cars and 60 computers, and Omega with 130 cars and 10 computers. Both are better off than they would be if they did not trade.

This is true even though Alpha has an absolute advantage in making both computers and cars. The reason is that each country has a different comparative advantage. Alpha’s edge is greater in computers than in cars. Omega, although a costlier producer in both industries, is a less expensive maker of cars. If each country specialises in products in which it has a comparative advantage, both will gain from trade.

In essence, the theory of comparative advantage says that it pays countries to trade because they are different. It is impossible for a country to have no comparative advantage in anything. It may be the least efficient at everything, but it will still have a comparative advantage in the industry in which it is relatively least bad.

There is no reason to assume that a country’s comparative advantage will be static. If a country does what it has a comparative advantage in and sees its INCOME grow as a result, it can afford better education and INFRASTRUCTURE. These, in turn, may give it a comparative advantage in other economic activities in future.

Competition

The more competition there is, the more likely are FIRMS to be efficient and PRICES to be low. Economists have identified several different sorts of competition. PERFECT COMPETITION is the most competitive market imaginable in which everybody is a price taker. Firms earn only normal profits, the bare minimum PROFIT necessary to keep them in business. If firms earn more than this (excess profits) other firms will enter the market and drive the price level down until there are only normal profits to be made.

Most markets exhibit some form of imperfect or MONOPOLISTIC COMPETITION. There are fewer firms than in a perfectly competitive market and each can to some degree create BARRIERS TO ENTRY. Thus firms can earn some excess profits without a new entrant being able to compete to bring prices down.

The least competitive market is a MONOPOLY, dominated by a single firm that can earn substantial excess profits by controlling either the amount of OUTPUT in the market or the price (but not both). In this sense it is a price setter. When there are few firms in a market (OLIGOPOLY) they have the opportunity to behave as a monopolist through some form of collusion (see CARTEL). A market dominated by a single firm does not necessarily have monopoly power if it is a CONTESTABLE MARKET. In such a market, a single firm can dominate only if it produces as efficiently as possible and does not earn excess profits. If it becomes inefficient or earns excess profits, another more efficient or less profitable firm will enter the market and dominate it instead.

Competitive advantage

Something that gives a firm (or a person or a country) an edge over its rivals.

Competitiveness

‘Real economists don’t talk about competitiveness,’ said Paul Krugman, a much-respected contemporary economist. Real businessmen and real politicians talk about it all the time, however. Many FIRMS have undergone savage downsizing to remain competitive, and governments have set up numerous committees to examine how to sharpen their countries’ economic performance.

Mr Krugman’s objection was not to the use of the term competitiveness by companies, which often do have competitors that they must beat, but to applying it to countries. At best, it is a meaningless word when applied to national economies; at worst, it encourages PROTECTIONISM. Countries, he claimed, do not compete in the same way as companies. When two companies compete, one’s gain is the other’s loss, whereas international trade, Mr Krugman argued, is not a ZERO-SUM GAME: when two countries compete through trade they both win.

Yet measures of national competitiveness are not complete nonsense. A country’s future prosperity depends on its GROWTH in PRODUCTIVITY, which GOVERNMENT policies can influence. Countries do compete in that they choose policies to promote higher living standards. Even so, conceptual and measurement difficulties mean that the growing number of indices purporting to compare the competitiveness of different countries should probably be taken with a large pinch of salt.

Complementary goods

When you buy a computer, you will also need to buy software. Computer hardware and software are therefore complementary goods: two products, for which an increase (or fall) in DEMAND for one leads to an increase (fall) in demand for the other. Complements are the opposite of SUBSTITUTE GOODS. For instance, Microsoft Windows-based personal computers and Apple Macs are substitutes.

Compound interest