Get more information regarding what percentage of college graduates have student loan debt, what is the percentage of college students that graduate with student loans, how many college students have student loans & what percentage of students take out loans for college.

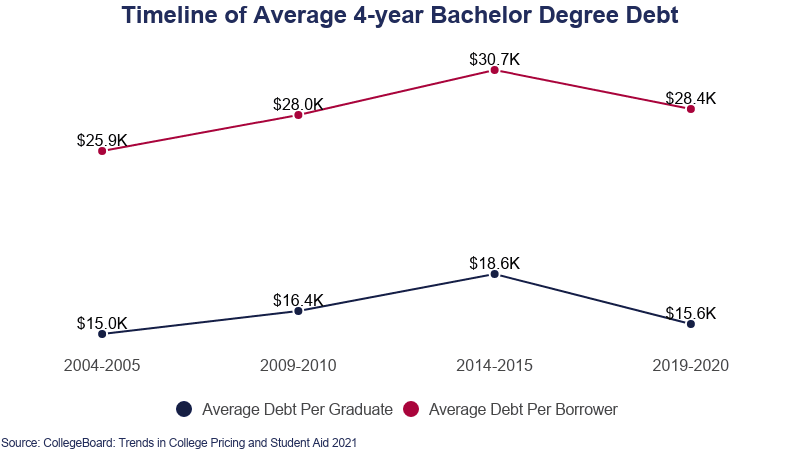

Average student loan debt has been on the rise as families try to keep up with soaring college costs. Though 2021 college graduates who borrowed to pay for school took out, on average, $208 less in loans compared with the prior year, the average total student debt continues to hover around $30,000, according to U.S. News data.

Eligible borrowers can expect some relief, however, as President Joe Biden announced plans in August to cancel some student loan debt. This will help some borrowers with federal loans, but won’t necessarily cover full need.

what percentage of college graduates have student loan debt

58% of students seeking a Bachelor’s degree from a public 4-year college have student loan debt. 42% of students seeking a Bachelor’s degree from a public 4-year college have no student loan debt. 14% of Bachelor’s degree graduates who went to a public 4-year school owe over $40,000 in debt.

eport Highlights. The average debt for a 4-year Bachelor’s degree is $34,100.

- The average 4-year Bachelor’s degree debt from a public college is $31,900.

- 65% of students seeking a Bachelor’s degree from a public 4-year college have student loan debt.

- The average 4-year Bachelor’s degree debt from a private for-profit college is $58,600.

- For private non-profit colleges, the average Bachelor’s degree debt is $34,300.

Related reports include Average Student Loan Debt | Total Student Loan Debt | Student Loan Debt by Race | Average Medical School Debt | Average Law School Debt

Public School 4-year Undergraduate Loan Debt

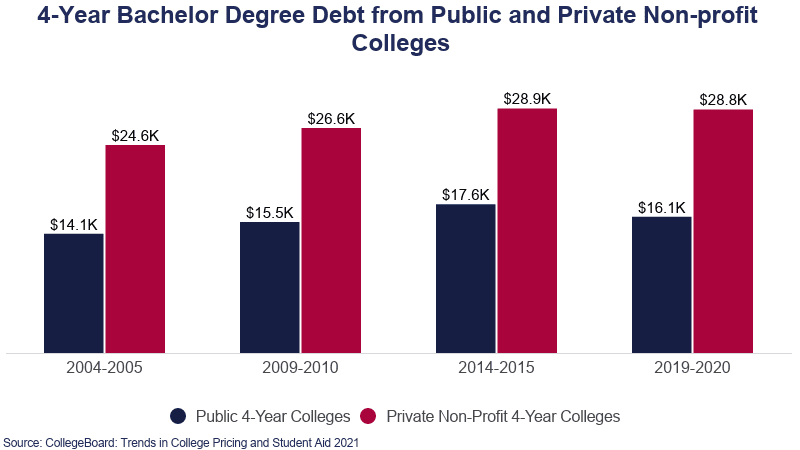

Students accrue less undergraduate loan debt from a public 4-year college than private schools because tuition is partially subsidized by state funding. Residents are given the cheapest tuition possible because resident taxpayer dollars go into funding state schools.

- The average 4-year Bachelor’s degree debt from a public college is $32,200.

- 58% of students seeking a Bachelor’s degree from a public 4-year college have student loan debt.

- 42% of students seeking a Bachelor’s degree from a public 4-year college have no student loan debt.

- 14% of Bachelor’s degree graduates who went to a public 4-year school owe over $40,000 in debt.

- 1 in 1,000 in-state public school Bachelor’s degree graduates will have $100,000 in student loan debt.

- 78% of students who graduate with a Bachelor’s degree from an in-state public school will have loan debt under $30,000.

| Year | Debt per Borrower | Debt per Graduate |

|---|---|---|

| 2004-2005 | $23,600 | $12,900 |

| 2009-2010 | $25,800 | $14,500 |

| 2014-2015 | $29,200 | $17,400 |

| 2019-2020 | $26,700 | $14,500 |

Private School 4-year Undergraduate Loan Debt

Students are saddled with more undergraduate loan debt from a private 4-year college because of the lack of state funding and tuition subsidization. Between private for-profit schools and private non-profit schools, Bachelor’s degree graduates typically accrue more debt at the for-profit schools.

- For private non-profit colleges, the average Bachelor’s degree debt is $34,300.

- The average 4-year Bachelor’s degree debt from a private for-profit college is $50,600.

- 20% of Bachelor’s degree graduates who went to a private non-profit 4-year school owe over $40,000 in debt.

- Roughly 50% of Bachelor’s degree graduates who went to a private for-profit 4-year school owed over $40,000 in debt.

- Private for-profit colleges award roughly 5% of the nation’s total annual Bachelor’s degrees.

| Year | Debt per Borrower | Debt per Graduate |

|---|---|---|

| 2004-2005 | $30,100 | $19,400 |

| 2009-2010 | $32,700 | $21,500 |

| 2014-2015 | $34,300 | $21,700 |

| 2019-2020 | $33,600 | $19,000 |

Public School vs Private School 4-year Undergraduate Loan Debt

This dataset comes from 2016 – before the 2020 pandemic suspension on student loan payments. Information about student loan debt from for-profit colleges is scarce. Only 3% of for-profit colleges release data about their student loan debt size.

- 83% of students from private for-profit 4-year colleges have student loan debt.

- Their student loan debt averaged $50,600.

- 30% of students with loans from for-profit colleges defaulted on their federal student loans within 12 years.

- 4% of students with loans from public colleges defaulted on their federal student loans within 12 years.

- 5% of students with loans from non-profit colleges defaulted on their federal student loans within 12 years.

Average 4-year Bachelor’s Degree Debt by State

The majority of the states with the highest levels of debt are located in the northeast. The low-debt states are primarily concentrated in the west. In 19 states the average debt was over $30,000 – 5 of them in particular had an average of over $35,000.

- Over the past 17 years, the student debt load has grown by twice the rate of inflation in 18 states.

- In 5 states, inflation outpaced the student debt load.

- New Hampshire has the highest average debt for students with a 4-year Bachelor’s degree – $39,930.

- Utah has the lowest average debt for students with a 4-year Bachelor’s degree – $18,344.

- At 73%, South Dakota is the state with the most amount of students in debt.

- At 39%, Utah is the state with the least amount of students in debt.

| State | Average Debt | Percent of Students with Debt |

|---|---|---|

| Alabama | $30,996 | 51% |

| Alaska | $26,356 | 47% |

| Arizona | $24,298 | 47% |

| Arkansas | $29,319 | 54% |

| California | $21,125 | 46% |

| Colorado | $26,424 | 49% |

| Connecticut | $35,853 | 57% |

| Delaware | $39,705 | 60% |

| District of Columbia | $32,966 | 46% |

| Florida | $24,454 | 47% |

| Georgia | $27,759 | 56% |

| Hawaii | $24,926 | 45% |

| Idaho | $24,983 | 58% |

| Illinois | $28,552 | 57% |

| Indiana | $28,521 | 57% |

| Iowa | $29,560 | 60% |

| Kansas | $26,002 | 60% |

| Kentucky | $28,356 | 61% |

| Louisiana | $26,284 | 53% |

| Maine | $32,764 | 63% |

| Maryland | $30,461 | 55% |

| Massachusetts | $33,457 | 56% |

| Michigan | $29,863 | 58% |

| Minnesota | $32,012 | 64% |

| Mississippi | $29,714 | 58% |

| Missouri | $28,713 | 56% |

| Montana | $27,114 | 55% |

| Nebraska | $26,781 | 60% |

| Nevada | $21,357 | 46% |

| New Hampshire | $39,928 | 70% |

| New Jersey | $35,117 | 63% |

| New Mexico | $20,868 | 45% |

| New York | $30,951 | 54% |

| North Carolina | $29,681 | 55% |

| North Dakota | $31,939 | 66% |

| Ohio | $30,605 | 59% |

| Oklahoma | $27,876 | 50% |

| Oregon | $26,504 | 53% |

| Pennsylvania | $39,375 | 64% |

| Rhode Island | $36,791 | 64% |

| South Carolina | $32,635 | 60% |

| South Dakota | $32,029 | 73% |

| Tennessee | $26,852 | 53% |

| Texas | $26,273 | 52% |

| Utah | $18,344 | 39% |

| Vermont | $34,866 | 57% |

| Virginia | $29,616 | 55% |

| Washington | $23,993 | 47% |

| West Virginia | $29,208 | 66% |

| Wisconsin | $30,270 | 63% |

| Wyoming | $23,510 | 48% |

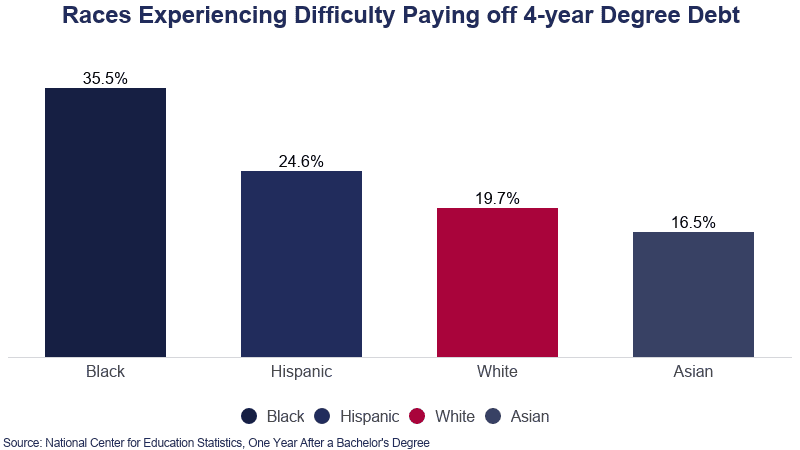

Average 4-year Bachelor’s Degree Debt by Race

In 2016, on average 22.4% of Bachelor’s degree graduates experienced difficulty repaying their student loans 1 year after graduation. The moratorium on student debt payments in 2020 aided an estimated 88% of all borrowers. The suspension also halted delinquencies and default collections on outstanding debt. The data below only includes debt from federal loans.

- In 2016, 86% of Black borrowers averaged a student loan debt of $43,200.

- White graduates had on average $31,200 in student loan debt from 4-year Bachelor’s degrees.

- 66% of White graduates had student loan debt.

- Black graduates have nearly $10,100 more debt than White graduates.

- Black borrowers who were experiencing difficulty paying their debt averaged $42,250 in student loans.

- 68% of Hispanic graduates have student loan debt.

- Hispanic borrowers without difficulty paying off their Bachelor’s degree debt averaged $25,450 in loans.

- Hispanic borrowers who experienced hardship trying to pay off their Bachelor’s degree debt averaged $34,750 in loans.

- Hispanic graduates borrowed on average $31,900 for a 4-year Bachelor’s degree.

- 43% of Asian graduates had student loan debt.

- Asian graduates borrowed on average $28,200 for a 4-year Bachelor’s degree.

- The table below is the percentage of graduates from each race experiencing difficulty with their student loan debt 1 year after graduation.

Average 4-year Bachelor’s Degree Debt by Gender

Women tend to borrow more and have higher rates of student loan debt than men when pursuing their 4-year Bachelor’s degree. Among women, Black women assume the largest amounts of undergraduate debt.

- 70% of female students take out student loans to pay for their 4-year undergraduate education.

- 63% of male students take out student loans to pay for their 4-year undergraduate education.

- Annually, 44% of women will take out loans for their undergraduate degree.

- Annually, 39% of men will take out loans for their undergraduate degree.

- Women take on roughly $400 more in student debt annually compared to men.

- In 2012, 1/3rd or 34% of Black women who graduated with a Bachelor’s degree had more than $40,000 in student debt.

- In comparison, 16% of Hispanic women had that level of debt, 10% of White women, and 8%

How Many College Students Have Student Loans

Student loan debt is a serious and growing problem in the United States. In this guide, we review the details of what percentage of college graduates have student loans, what is the average student loan debt for a bachelor degree, total student loan debt, average student loan debt per month and why is student debt a problem. In this guide, we review the details of what percentage of college graduates have student loans, what is the average student loan debt for a bachelor degree, total student loan debt, average student loan debt per month and why is student debt a problem.

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/50179193/152599449.0.jpg)

We’re not going to sugarcoat it: student debt is a serious issue facing Americans in their 20s and 30s. Everyone knows that college is expensive, but how much debt is too much? What percentage of college graduates have student loans? How much debt do they take on? And what can you do about it? Read on to know more about what percentage of college graduates have student loans, what is the average student loan debt for a bachelor degree, total student loan debt, average student loan debt per month and why is student debt a problem.

what percentage of college graduates have student loans

We begin with what percentage of college graduates have student loans, then what is the average student loan debt for a bachelor degree, total student loan debt, average student loan debt per month and why is student debt a problem.

The average debt at graduation from four-year public and private nonprofit colleges was $28,400 in 2020, a $400 decrease from 2019.

55% of bachelor’s degree recipients graduating from four-year public and private nonprofit colleges in 2020 had student loan debt.

More shocking student loan debt statistics

If those numbers weren’t stunning enough, here’s a closer look at how students accumulate debt based on the type of school they attend:

- 55% of bachelor’s degree recipients graduating from four-year public and private nonprofit colleges in 2020 had student loan debt.

- The average debt at graduation from four-year public and private nonprofit colleges was $28,400 in 2020, a $400 decrease from 2019.

- 66% of graduates from public colleges had loans (borrowing an average of $26,900), according to 2016 data from an April 2019 report — the latest available.

- 68% of graduates from private, nonprofit colleges had loans in 2016 (borrowing an average of $31,450).

- 83% of graduates from for-profit colleges had loans in 2016 (borrowing an average of $39,900).

- Students and parents borrowed an estimated $95.9 billion in the 2020-2021 academic year, and 13% of that were private and other non-federal loans.

- 48% of borrowers who attended for-profit colleges default within 12 years, compared with 12% of public college attendees and 14% of nonprofit college attendees.

what is the average student loan debt for a bachelor degree

Now we review what is the average student loan debt for a bachelor degree, total student loan debt, average student loan debt per month and why is student debt a problem.

The average student loan debt for a 4-year Bachelor’s degree is $28,800. The average 4-year Bachelor’s degree debt from a public college is $27,000. 65% of students seeking a Bachelor’s degree from a public 4 year college have student loan debt. The average 4-year Bachelor’s degree debt from a private for-profit college is $39,900.

The average student loan debt for those who graduate from a two-year Associate’s degree program is $11,700. 30% of students seeking an Associate’s degree from a public 2 year college have student loan debt, while only 9% of students seeking an Associate’s degree from a private for profit 2 year college have student loan debt.

total student loan debt

More details coming up on total student loan debt, average student loan debt per month and why is student debt a problem.

The student loan debt crisis is growing, and it’s affecting more than just the borrowers themselves.

According to a recent article from the Federal Reserve Bank of St. Louis, student loan borrowers in the United States owe a collective nearly $1.75 trillion in federal and private student loan debt as of April 2022. This is up from $1.52 trillion from April 2019.

The problem is getting worse: The number of borrowers who are delinquent on their loans has increased by 2 million since December 2018, and collection agencies have been busy trying to recoup some of their losses through debt collections lawsuits against delinquent borrowers.

average student loan debt per month

The average monthly student loan payment is an estimated $460 based on previously recorded average payments and median average salaries among college graduates. The average borrower takes 20 years to repay their student loan debt.

This means that if you borrowed $100,000 in loans at an interest rate of 5%, you would pay back a total of $210,000 in interest over the course of 20 years.

It is important to note that these statistics only apply to undergraduate degrees; those with graduate degrees typically have higher salaries and pay off their loans more quickly than those who only have an undergraduate degree.

why is student debt a problem

College graduates are drowning in debt but it didn’t have to be this way. Steadily, tuition increases have outpaced incomes forcing families to rely on student loans to help foot the bill. At this pace, “outstanding student loan debt could topple $3 trillion by 2035,” according to one expert.

As the cost of college has risen, so too has the number of students taking out loans. In fact, between 2004 and 2014 alone, the number of college students taking out loans increased by about 40%.

It’s no wonder that so many young people are struggling with student debt—after all, a college degree is more critical than ever before in today’s economy. If you want to make a living wage or have any hope of achieving financial independence (or at least being able to pay off your own loans), then you need a bachelor’s degree or higher.

And yet even as the value of a degree grows, the cost keeps going up. What does this mean for aspiring students who want an education? How do they afford it? And can they ever get ahead if they’re stuck paying off tens of thousands of dollars in debt?

is there a penalty for paying off federal student loans early

Paying off student loans early can be a smart decision that gives you more freedom and flexibility. You can always pay off your federal or private student loans ahead of schedule by paying more than the minimum each month.

Paying off your student loans early means you’ll pay less interest over the life of the loan.

But if you’re putting more money toward paying down your student loans, you’ll have less money available for other financial goals and obligations. That’s why it’s crucial to think about what your financial goals are and how much money you’ll need to save to reach them. Then, look into whether you can pay off your student loans early at the same time.

If you’re wondering how long it’ll take to pay off your student loans, enter your current loan information into the calculator below to find out. Use the slider to see how increasing your payments can change the payoff date.

Enter loan informationLoan balance

?Enter the remaining balance of your loans$Interest rate

?Enter the average annual interest rate of your loans%Loan term

?Enter the amount of time left to repay your loanyears

What if you increased your monthly payment?

+ $0

Total Payment$75,953

Total Interest$20,953

Monthly Payment$633

If you increase your payments by $0 monthly on your $55,000 loan at 6.8%, you will pay $633 a month and pay off your loan by January 2033.

Does refinancing make sense for you?

Compare offers from top refinancing lenders to determine your actual savings.

Checking rates won’t affect your credit score.

1. If you have an emergency fund

Yes, paying off your student loans early is a good idea.

Before considering making extra payments toward your loans, it’s a good idea to have an emergency fund. An emergency fund is money set aside in a bank account to cover sudden crises, such as an unexpected car repair, job loss, or illness.

Having an emergency fund ensures you won’t have to turn to credit cards when faced with a problem. But if you don’t have an emergency fund yet, you should consider holding off on making extra payments on your loans and put that cash toward your savings first.

Tip: You typically want to have three to six months’ worth of expenses in your emergency fund.

Learn More: How to Pay off Student Loans in 5 Years

2. If you have lots of credit card debt

No, paying off your student loans early is not a good idea.

If you have credit card debt, paying off your balance should be the priority before turning to your student loans. While student loans can have high interest rates, credit card interest rates can be staggering. The average credit card interest rate was 16.44% as of the fourth quarter of 2021, according to Federal Reserve data.

With such high rates, you’ll probably save more money by paying off your credit card debt first than if you focused on your student loans. Take a look at how much you’d pay in interest on your credit card debt and student loans over the course of five years:

| Rates (APR) | Interest Paid | |

|---|---|---|

| Credit cards | 16.44% | $4,731 |

| PLUS Loans | 6.28% | $1,678 |

| Graduate student loans | 5.28% | $1,400 |

| Undergraduate student loans | 3.73% | $977 |

| Interest paid is based on $10,000 total for all loan types paid over a five-year term. Federal student loan rates are accurate for the 2021-22 academic school year. |

Keep in mind that your credit card interest rate and loan APR are specific to you. So, do your own calculation to see what makes the most sense for your situation.

Find Out: How to Pay Off Credit Card Debt Fast

3. If your student loans have high interest rates

Yes, paying off your student loans early is a good idea.

If you have high student loan interest rates — federal student loans can have rates as high as 8.5%, while private loans can be even higher — a good deal of your monthly loan payment goes toward interest rather than principal, increasing how much you’ll pay over time. Paying off your private or federal loans early can help you save thousands of dollars over the life of your loan since you’ll be paying less interest.

If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans. With a stable income and good credit score, you could qualify for a low interest rate, helping you save more and become debt-free faster. Plus, there’s no limit to how many times you can refinance and you won’t pay any fees either.

https://www.credible.com/refinance/embedded-prequal?credclid=094e1171-a9f0-4915-bb79-e726c411f90b&theme=default&pageUrl=https%3A%2F%2Fwww.credible.com%2Fblog%2Frefinance-student-loans%2Fpay-off-loans-early%2F&partnerPageUrl=https%3A%2F%2Fwww.credible.com%2Fblog%2Frefinance-student-loans%2Fpay-off-loans-early%2F&source=credible_blog&utm_campaign=https%3A%2F%2Fwww.credible.com%2Fblog%2Frefinance-student-loans%2Fpay-off-loans-early%2F&utm_medium=partner_integration_embedded_prequal&utm_source=credible_blog&utm_content=embedded-prequal

See Also: How to Lower Your Student Loan Interest Rate

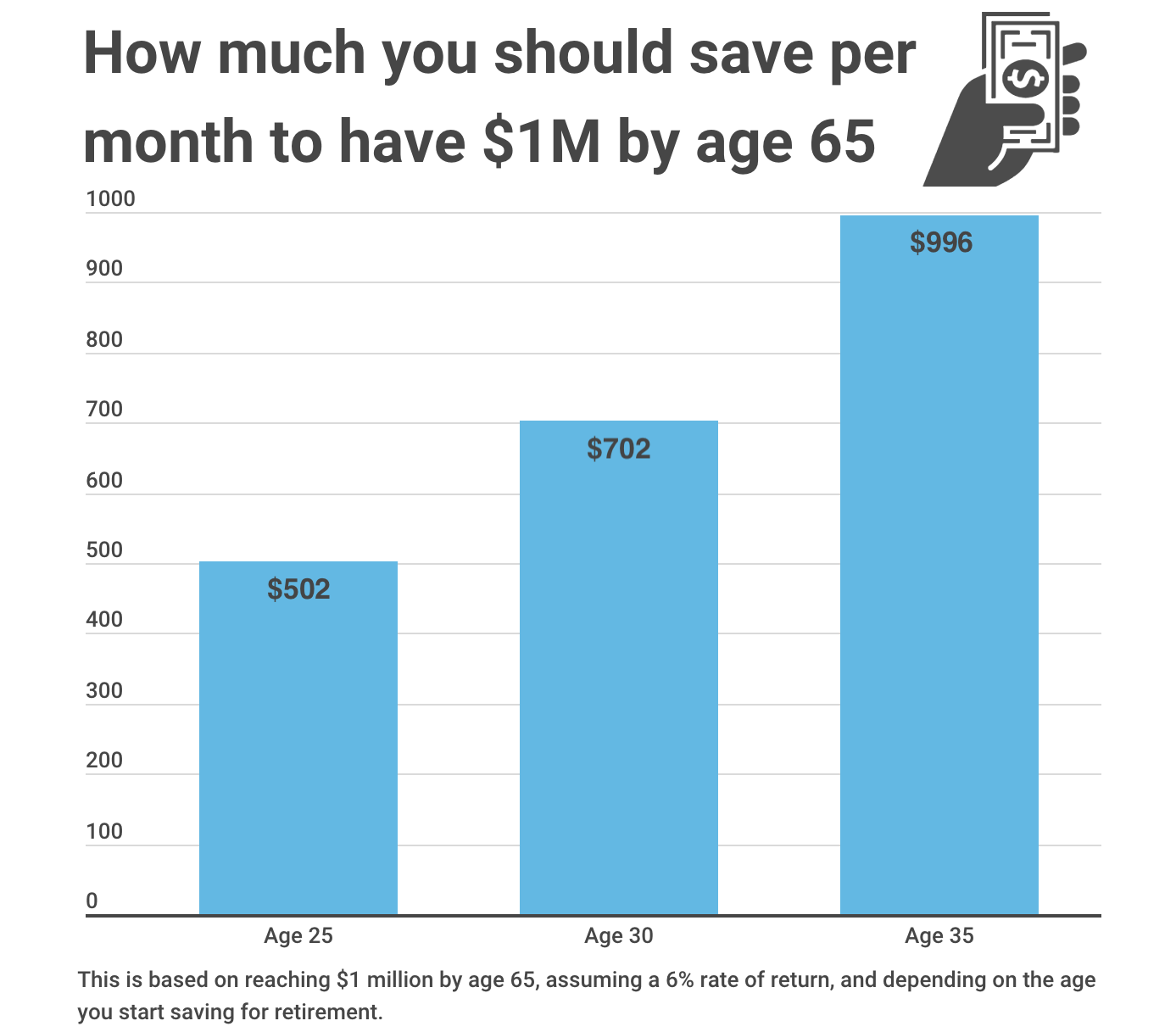

4. If you don’t contribute to your retirement and get the max employer match

No, paying off your student loans early is not a good idea.

When you have student loans, future goals like retirement may not seem that important. But it’s important to invest now, while you’re young. This gives your money time to grow so you can have a comfortable retirement.

Not all employers offer 401(k) matching, but many offer a match up to a certain amount or percentage. So at the minimum, it’s a good idea to contribute enough to employer-offered retirement plans to qualify for the full match before making extra payments on your debt.

5. If you’re already contributing to other life goals

Yes, paying off your student loans early is a good idea.

When your finances are in good shape, deciding what’s best to do with extra money can be difficult. If you have student loan debt, you might think about paying it down aggressively. Just make sure you’re contributing to your long-term goals as well, or else paying student loans off early could set you too far back.

Here are some long-term goals you should consider contributing to first:

- Saving for a house

- Investing

- Paying off higher-interest debt

Learn More: 10 Mistakes to Avoid as a First-Time Homebuyer

Pros and cons of paying off student loans early

Paying off your student loans early has benefits and drawbacks.

Pros of paying off student loans early

- You can improve your debt-to-income ratio, or DTI, which is what lenders look at when considering you for loans like mortgages.

- Being free from student loan debt can help you divert your previous monthly payments toward other financial goals.

- It can be less stressful not having to manage debt, even if it may make more sense from an interest perspective to invest the money instead.

Cons of paying off student loans early

- You could lose out on loan forgiveness by paying off your federal student loans early.

- Large loan payments could mean a tighter budget.

- You may not be able to reach your other financial goals as quickly.

How to pay off student loans quickly

If your student loans weigh you down, cause you anxiety, or make you feel like you can’t pursue other goals while you have them, it might be worth tackling them early.

While it seems like it can be impossible, you can pay off your student loans faster. Here are some strategies you can use:

- Make more than the minimum payment. Paying more than the minimum payment each month — even if it’s an extra $50 or $100 — can help you chip away at your debt faster.

- Pay bi-weekly. Making a payment every other week instead of monthly equates to one full extra payment each year.

- Pick up extra work. Taking on a part-time job or side hustle can help you pay down your student debt faster if you apply all your extra money toward your loan balances.

- Use windfalls or extra cash. If you receive an unexpected source of income, like an inheritance or cash, you can apply it toward your student loans to reduce the amount you owe.

- Refinance. If you’re able to qualify for a lower interest rate, refinancing your student loans can help lower your monthly payment or speed up your payoff timeline by shortening your repayment term. Just be careful before refinancing federal loans into a private loan: If you do this you’ll lose access to federal benefits, like income-driven repayment plans and loan forgiveness.

Getting rid of your student loan debt can give you a sense of freedom and independence you wouldn’t otherwise have if you let the debt linger. It can also motivate you to work toward paying down your other debt.

Learn More: Using the Debt Snowball Method to Pay Off Debt

Save more by refinancing your student loans

If you’re financially ready to start paying off your student loans early, refinancing your loans can be a smart way to save money and pay off your student loans faster.

Credible’s done the heavy lifting for you! Instead of spending hours or even days applying with multiple lenders individually, we’ve partnered with some of the top refinancing lenders so you don’t have to. Just fill out one, simple form and you can get prequalified rates from multiple lenders — all without affecting your credit score.